Table Of Contents

- Why Asking Questions Before Spending Matters

- Question #1: “Do I Really Need This, Or Do I Just Want It?”

- Need vs. Want: What Is The Difference?

- Why This Question Is Effective

- A Useful Hint

- Question #2: “Is This Worth The Money In The Long Run?”

- Considering The Price No Matter What

- Long-Term Value Vs. Instant Gratification

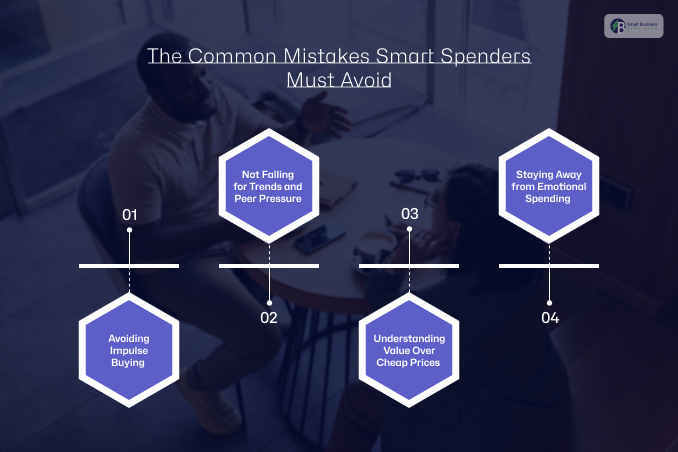

- What Are The Common Mistakes Smart Spenders Must Avoid?

- 1. Avoiding Impulse Buying

- 2. Not Falling For Trends and Peer Pressure

- 3. Understanding Value Over Cheap Prices

- 4. Staying Away From Emotional Spending

- How To Build This Habit Easily

- 1. Start With Minor Purchases

- 2. Employ Simple Reminders

- 3. Allow Time For Yourself

- Real-Life Benefits Of Asking These Questions

- 1. More Savings Without Feeling Restricted

- 2. Fewer Regret Purchases

- 3. Less Financial Stress

- 4. Better Control Over Your Money

What Are Two Questions That Smart Spenders Ask Before Making A Purchase?

So, what are two questions that smart spenders ask before making a purchase?

Every day, we make purchases, and money goes toward food, clothing, electronic devices, and monthly subscriptions, and occasionally toward items we no longer remember buying.

Did you ever check your bank statement and wonder, “What was the reason for this purchase?” You are certainly in good company.

People with smart spending habits are not those who do not shop at all or who do not enjoy life as much.

They are simply people who take a moment to think about their purchase before asking the right questions.

In fact, smart spenders ask two questions before making a purchase, which helps them avoid regret, save money, and make better buying decisions.

Let’s take a closer look at these questions, straightforwardly and practically, and discover how you can incorporate them into your life today.

Why Asking Questions Before Spending Matters

“What are two questions that smart spenders ask before making a purchase?” Impulse purchases are now more convenient than ever. A single click, a single swipe, a single discount notification, and just like that, the money is gone.

Businesses are incredibly good at creating a sense of urgency around their products.

Wise consumers do not depend solely on their willpower. They depend on their thought processes.

They can defer emotional outflow by asking the same questions every time, thereby shifting it to the outflow of intent.

Thus, it is really powerful to know the two questions smart spenders ask before making a purchase.

Question #1: “Do I Really Need This, Or Do I Just Want It?”

This is the first and foremost question that smart spenders will definitely ask. It is perfectly okay to desire things. The issue arises when desires are equated with needs.

Need vs. Want: What Is The Difference?

Needs are the things that you cannot live without: food, basic clothing, rent, utilities, and transport to work.

Wants are the luxurious things: the latest phone, designer shoes, another streaming service, and trendy kitchen gadgets.

Smart spenders do not straightaway refuse want but instead identify them as such.

Why This Question Is Effective

By asking yourself, “Do I really need this?”, you create a moment. That moment is very important. It shatters the buying fever and allows reason to come in.

Illustration:

- You possess a set of functioning headphones.

- A discount is being offered on a new pair.

This question leads you to the conclusion: I desire superior ones, but do not need them for the time being.

That one realization may instantly reduce your spending.

A Useful Hint

If you have doubts, apply the 24-hour rule. Delay the purchase by a day. And now, if you continue to have the same feeling, it might be worth it. If not, you just made a money-saving move.

Such a simple technique is why this question remains among the two questions smart spenders always ask before making a purchase.

Question #2: “Is This Worth The Money In The Long Run?”

The second query that wise buyers pose regarding value, not only price, brings the issue directly to the table.

The low price tag is not always a sign of good value, and the exorbitant price does not always mean one is paying for value.

Considering The Price No Matter What

The smart spenders bear the future in their minds. Their questions are:

- How long will this last?

- Is the frequency of my use going to be high?

- Is there a real problem that this will solve?

- Am I buying quality or just the brand name?

An example would be:

More often, buying and then replacing cheap shoes that disintegrate within three months can be more expensive than purchasing a single robust pair.

A low-cost subscription you never use is still money thrown away.

Long-Term Value Vs. Instant Gratification

The combined use of both questions reveals the real power of smart spending. Only one question is not enough.

When the smart spenders put the first question, “Do I really need this, or do I just want it?” they become conscious of their driving force. This phase is the one that differentiates emotional buying from practical ones.

After that, the second question appears: “Is this worth the money in the long run?” This changes the focus from the short-term thrill to the long-term benefit.

For example, you might realize you want a new gadget, but you do not really need it.

However, if it saves time, increases productivity, or lasts long, it might still be a smart purchase.

Conversely, if it provides only a bit of gratification, it would be easier to turn down the offer.

The two questions together help buyers deliberately spend, reduce regret, and feel confident about their financial decisions, without feeling guilty for enjoying their money.

What Are The Common Mistakes Smart Spenders Must Avoid?

While understanding “what are two questions that smart spenders ask before making a purchase?”, it is also necessary to take a look at the common mistakes that you must avoid while shopping.

Smart spenders do not merely seek to save money. Instead, they identify habits that are largely unnoticed yet still drain their wallets.

By being conscious of their habits, they can avoid the common traps that lead to spending.

1. Avoiding Impulse Buying

Smart spenders do not fall prey to impulse buying, a habit that takes them to the cashier, especially during special sales or limited-time offers.

Discounts often create a sense of urgency that leads one to buy unnecessary items.

Instead of acting emotionally to deals, smart spenders stop and think before making a purchase.

2. Not Falling For Trends and Peer Pressure

Another mistake they sidestep is buying just to be in vogue or to please the group. No matter whether it is the newest gadget or a viral product, wise spenders always inquire if it is really worth their money before purchasing.

3. Understanding Value Over Cheap Prices

Smart spenders are careful not to misinterpret cheap for value. Low-cost products usually do not last long and thus require frequent replacement.

This ends up costing more in the long run. Quality and efficiency are more important than price tags.

4. Staying Away From Emotional Spending

Smartest of all, the money-savers practice the avoidance of emotional spending, i.e., they do not engage in buying when they are

- Under stress,

- Feeling bored,

- Depressed.

They are aware of their emotions, which helps them make rational financial decisions that carry less regret, even if they are not happy.

Also Check: What Are Five Marketing Strategies That Retailers Spend Half of Their Annual Budget On?

How To Build This Habit Easily

The practice of spending wisely and the like does not involve strict budgets nor complicated rules.

It begins with tiny, continued actions. The most convenient option is to linger for a while before each purchase.

Here, you can ask yourself the same two questions again and again. This brief delay is effective in curbing the impulsive action.

1. Start With Minor Purchases

Implement this habit, for instance, when ordering food deliveries or online shopping.

It becomes much easier to ask about minor purchases and, therefore, to apply them later to larger expenses.

2. Employ Simple Reminders

You may want to jot down the questions on a sticky note, set them up as a reminder on your phone, or just carry them around in your wallet. These simple cues are a great help in making you think before you spend.

3. Allow Time For Yourself

Night-to-day habits do not form. The more frequently you go through this process, the more it gets.

After some time, you will not even notice that you are practicing smart spending; it will be a part of your life, not a struggle.

Real-Life Benefits Of Asking These Questions

It might seem like asking the right questions before spending is just a small thing, but the effect it can have is enormous.

Those who adopt this habit daily experience positive changes in their finances and mindset.

1. More Savings Without Feeling Restricted

Whenever you do not purchase impulsively, the account has more money, which stays in it naturally.

You are not cutting off fun. You are just preventing unnecessary costs. Little by little, the savings will accumulate over time without feeling like a sacrifice.

2. Fewer Regret Purchases

Smart consumers rarely fall into the trap of feeling remorseful after making a purchase.

The reason is that their purchases are so well-thought-out that there is more satisfaction and less guilt after spending.

3. Less Financial Stress

Being aware of your money movements creates an atmosphere of tranquility. You feel more powerful. Thus, the anxiety that comes with bills and economic shocks is reduced.

4. Better Control Over Your Money

Money will not be your master anymore; you will master it. Moreover, the greatest thing is that you live life to the fullest; you just spend with awareness and confidence.