Table Of Contents

- What Is The Selling Price?

- Definition And Key Terms

- How Selling Price Differs From Other Terms

- Why Selling Price Matters In Business

- Core Selling Price Formulas

- 1. The Basic Selling Price Formulas

- 2. Using Profit And Loss Percentages

- 3. Selling Price With Discounts

- 4. The Real World Selling Price Formula: Taxes & Fees

- Pricing Strategy Meets Formula

- Cost-Plus Pricing Method

- Markup Pricing

- Demand And Value-Based Pricing

- Selling Price Calculator & Worked Examples

- Scenario 1: Retail Price With Tax And Discount

- Scenario 2: Wholesale vs. Retail Scaling

- Scenario 3: Ecommerce Fees + Profit Target

- Expert Tips & Best Practices

The Ultimate Guide To The Selling Price Formula (With Examples & Business Strategies)

Ever wonder why a product costs what it does? Whether you are running a side hustle or a massive store, the selling price is the magic number that you charge your customers.

It is like the heartbeat of your business! Because it determines if you actually make money or just break even!

But do not confuse these terms with others. Your overall cost price is what you paid to make or buy the item, while the market price is what competitors are currently charging.

According to Investopedia, getting this right is the difference between growth and closing shop.

The math is actually pretty simple!

If you want to make a profit, you can just use the formula: Selling Price = Cost Price + Profit.

If you’re clearing stock at a hit, the formula would be: Selling Price = Cost Price – Loss.

In this guide, we’ll break down the step-by-step selling price formula and real-world examples to help you master your pricing strategy. Let’s dive in!

What Is The Selling Price?

So, you have got a great product. Now, how do you decide what to charge? The selling price is simply the final amount a customer pays for your goods and services.

It sounds basic. However, this single number carries the weight of your entire business on its shoulders.

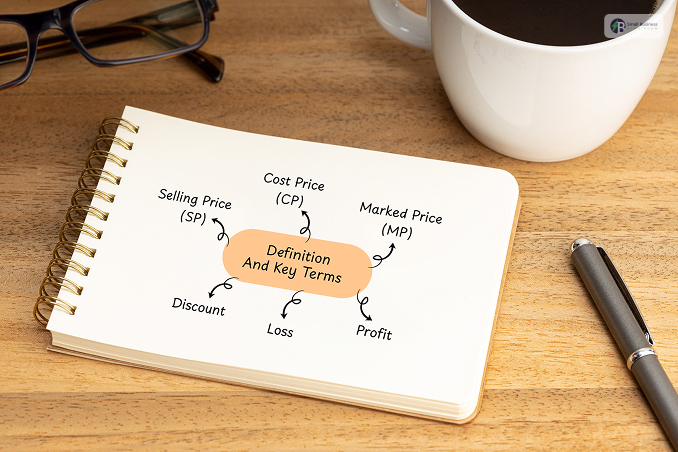

Definition And Key Terms

Before we start crunching numbers, let’s understand the basics of the language. You can think of the building blocks of your bank account:

- Selling Price (SP): The actual price you sell your item for.

- Cost Price (CP): Everything you spent to get the product ready (materials, labor, shipping).

- Marked Price (MP): The “sticker price” or MSRP you show before any sales.

- Profit: The sweet extra cash you keep when SP is higher than CP.

- Loss: What happens if you have to sell for less than what you spent?

- Discount: The reduction you give from the Marked Price to lure in shoppers.

| Goal | Selling Price Formula |

| Basic Price | Selling Price = Cost Price + Profit |

| When On Sale | Selling Price = Marked Price – Discount |

| In Bad Times | Selling Price = Cost Price – Loss |

How Selling Price Differs From Other Terms

It is easy to mix these up. However, they serve different masters. SP is all about the customers. The cost price is about your expenses.

Then, we have the M words: The markup and margin. Here, the markup is the percentage you add to your cost to reach the selling price.

Margin, on the other hand, is the percentage of the selling price that actually profits.

For example, if you buy for $70 and sell for $100, your markup is about 43%. However, your margin is 30%.

Thus, you must know the differences. It can help you to talk to the investors and further track your actual health.

| Term | Focus | Simple Definition |

| Selling Price | Customer | What they pay at checkout. |

| Cost Price | Internal | What you pay the supplier. |

| Markup | Growth | The “extra” was added to the cost. |

| Margin | Profitability | How much of the total price is profit? |

Why Selling Price Matters In Business

Setting the right price is not just about greed. It’s about survival. First, it dictates your profitability.

If your SP is too low, you are basically running a charity. Secondly, it helps you find your break-even point, which is the moment you stop losing money and start making it.

The context also changes depending on where you sell. In a brick-and-mortar store, your SP must cover high rent and electricity.

In e-commerce, your price might be lower to stay competitive, but you have to account for shipping fees and digital ads. If you do not balance these, your business will not last the year.

Ignoring these details is a top reason why small business ideas fail within the first year.

Core Selling Price Formulas

Want to do some quick math? Don’t worry. You don’t need to be a genius. For most cases, pricing involves a few basic “recipes.”

Once you know the ingredients, you can set prices to keep customers happy and your money coming in.

1. The Basic Selling Price Formulas

Pricing is basically balancing what you spend with what you want to earn.

When things go well:

SP = CP + Profit

Example: You buy a handmade mug for $10 (Cost Price) and want $5 profit. Your Selling Price is $15.

When you need to clear stock:

SP = CP – Loss

Example: You buy a seasonal shirt for $20, but it isn’t selling. You take a $5 loss to move it. Your Selling Price is $15.

2. Using Profit And Loss Percentages

Most business owners think in percentages, not flat dollars. Here’s how to work it out on the fly.

Selling Price with Profit %:

SP = CP × (1 + Profit % / 100)

Example: You buy a gadget for $50 and want 20% profit.

$50 × (1 + 0.20) = $60.

Selling Price with Loss %:

SP = CP × (1 – Loss % / 100)

Example: The same $50 device is now outdated, and you’re fine with a 10% loss.

$50 × (1 – 0.10) = $45.

3. Selling Price With Discounts

If you do a Weekend Flash Sale, begin with your Marked Price (the price on the tag).

Selling Price Formula: SP = Marked Price – Discount

Example: You put up a watch for $100 and give a 15% discount ($15 off). Your Selling Price is $85.

4. The Real World Selling Price Formula: Taxes & Fees

If you sell on Amazon or Shopify, remember the hidden costs. You pay the seller credit, the platform’s fee, and taxes (such as GST and VAT) from your total.

The Business Use Case:

Suppose you sell a phone case. To determine your actual Selling Price, you have to factor in these expenses:

Cost of the case: $5

Amazon Referral Fee (about 15%): $1.50

Taxes (such as 10%): $1.00

Your profit: $2.50

You cannot simply charge $7.50. You have to factor in these expenses first. According to Investopedia, ignoring these small fees is one of the most common mistakes new sellers make.

In any case, always compute your Net Selling Price by adding these costs before you put up your item. It is better to charge a little higher now than to lose money later.

You Can Also Check: Meesho Supplier Panel: Know The Best Features And Login Process (2026 Guide)

Pricing Strategy Meets Formula

Equations are great, but they don’t live in a vacuum. You need a strategy to decide which numbers to plug in. Let’s look at how successful businesses actually pick their winning price.

Cost-Plus Pricing Method

This is the “old reliable” of the business world. To use this, simply add a specific dollar amount (your “plus”) to your total cost to ensure you make a profit.

It’s very popular because it’s simple and protects your margins.

The Upside: It’s easy to calculate and ensures every sale covers your bills.

The Downside: It ignores what customers are actually willing to pay. For example, if you make a high-value software product that costs almost nothing to replicate.

Whereas the cost-plus pricing might leave a lot of money on the table compared to Value-Based Pricing.

Markup Pricing

You’ll hear “markup” used a lot in retail. This is the percentage you add to your cost price to reach your selling price.

Formula: SP = Cost Price + (Cost Price × Markup %)

Wait, isn’t that just margin? Not exactly. They use the same numbers but look at them differently.

Markup is the amount you add to the cost. Margin is how much of the final selling price you keep.

If you buy a shirt for $50 and sell it for $100, that’s a 100% markup but a 50% profit margin. Knowing this helps you stay profitable when you start offering discounts.

Demand And Value-Based Pricing

Sometimes cost doesn’t matter at all. Value-based pricing is all about what the customer thinks your product is worth.

Think of a bottle of water at a concert versus at the grocery store. Same cost, but the price is higher because the value to the thirsty fan is higher.

This often leads to Dynamic Pricing, where your selling price changes in response to real-time demand. Apps like Uber or airline websites do this all the time.

If everyone wants the same thing at the same time, the price goes up. It’s a smart way to max revenue when you have a limited supply.

Selling Price Calculator & Worked Examples

Numbers can be boring until you see them in use. Now, let’s examine how these equations are used in the real world.

Whether you are selling one shirt or filling a warehouse, these steps will keep your calculations in line.

Scenario 1: Retail Price With Tax And Discount

Suppose you own a retail business. You have a product, a dress, that you sell for $40 (Cost Price).

However, you also want to make a profit of $20. But you also want to give your customers a 10% discount. And, of course, you have to pay a 5% sales tax.

Calculate Base Selling Price: $40 (Cost) + $20 (Profit) = $60.

Add Tax (5%): $60 × 1.05 = $63.

Apply Discount (10% off the $63): $63 – $6.30 = $56.70.

Your Final Selling Price: $56.70. You still made your profit, even with the discount!

Scenario 2: Wholesale vs. Retail Scaling

Perhaps you are a wholesale manufacturer. You sell your goods in bulk to other retailers, who then sell to the public. It’s a never-ending cycle.

| Level | Cost | Markup | Selling Price |

| Wholesaler | $10 (to make) | 50% | $15 |

| Retailer | $15 (to buy) | 100% | $30 |

The retailer’s Cost Price is your Selling Price. When you expand, ensure that your wholesale price is low enough for the retailer to add a markup and remain competitive.

Scenario 3: Ecommerce Fees + Profit Target

Selling on Amazon or Etsy is easy, but they charge a fee. Let’s say you sell a device for $100 and aim for a 25% net profit.

Product Cost: $40

Platform Fee (15%): $15

Shipping & Packaging: $10

Target Profit (25%): $25

Total Needed: $40 + $15 + $10 + $25 = $90

Since your total needed is $90, charging $100 is a very safe margin in case you need to pay for something unexpected or advertise.

According to Investopedia, the “only way to avoid growing yourself broke” is to keep track of these fees.

Expert Tips & Best Practices

Setting the right price is not a “one and done” task. It is about the living part of your business. To succeed in 2026, you need to be more flexible and firm on your numbers.

First, let’s talk about inflation. If your suppliers raise their prices, you must adjust your prices immediately.

So, do not just wait until you are losing money to make a move! The small and incremental increases are much easier for customers to swallow than a massive price jump later.

Next, you have to watch your competitors. But do not obsess over them! It is always the cheapest that might make people think that your quality is low!

Instead, you just have to focus on your value. Maybe you can offer faster shipping or better support? That extra allows you to charge more!

Also, avoid the classic mistake of ignoring overheads. Your selling price has to cover more than just the product.

Just think about your electricity, software subscriptions, and even your own time! If you don’t have these in your equation, your profit is just an illusion.

Finally, always put margin first, not markup. Markup is what you added, but margin is what you kept.

In a hard market, the only way to know if you can afford a sale is to know your true margin. Remember these tips, and you’ll build a business that lasts.