Table Of Contents

- What Is Hurdlr? A Quick Overview

- Why It Matters In 2025?

- What Are The Core Functions & Features?

- Expense & Income Tracking

- Mileage Tracking & Auto Logging

- Tax Estimation & Deductions

- Invoicing, Accounting & Reporting (Professional Tier)

- Time Tracking & Client Billing

- Integrations & Connectivities

- Hurdlr Pricing & Plans (Free, Premium, Pro, Enterprise)

- Real‑User Feedback & Common Issues

- What Users Like

- What Users Complain About

- Tips to Get the Best Experience

- Hurdlr vs Competitors

- Is Hurdlr Safe & Reliable?

- Advanced Use Cases & Scaling

- How to Use Hurdlr Effectively?

- Is Hurdlr Right for You? The Final Words

- Frequently Asked Questions

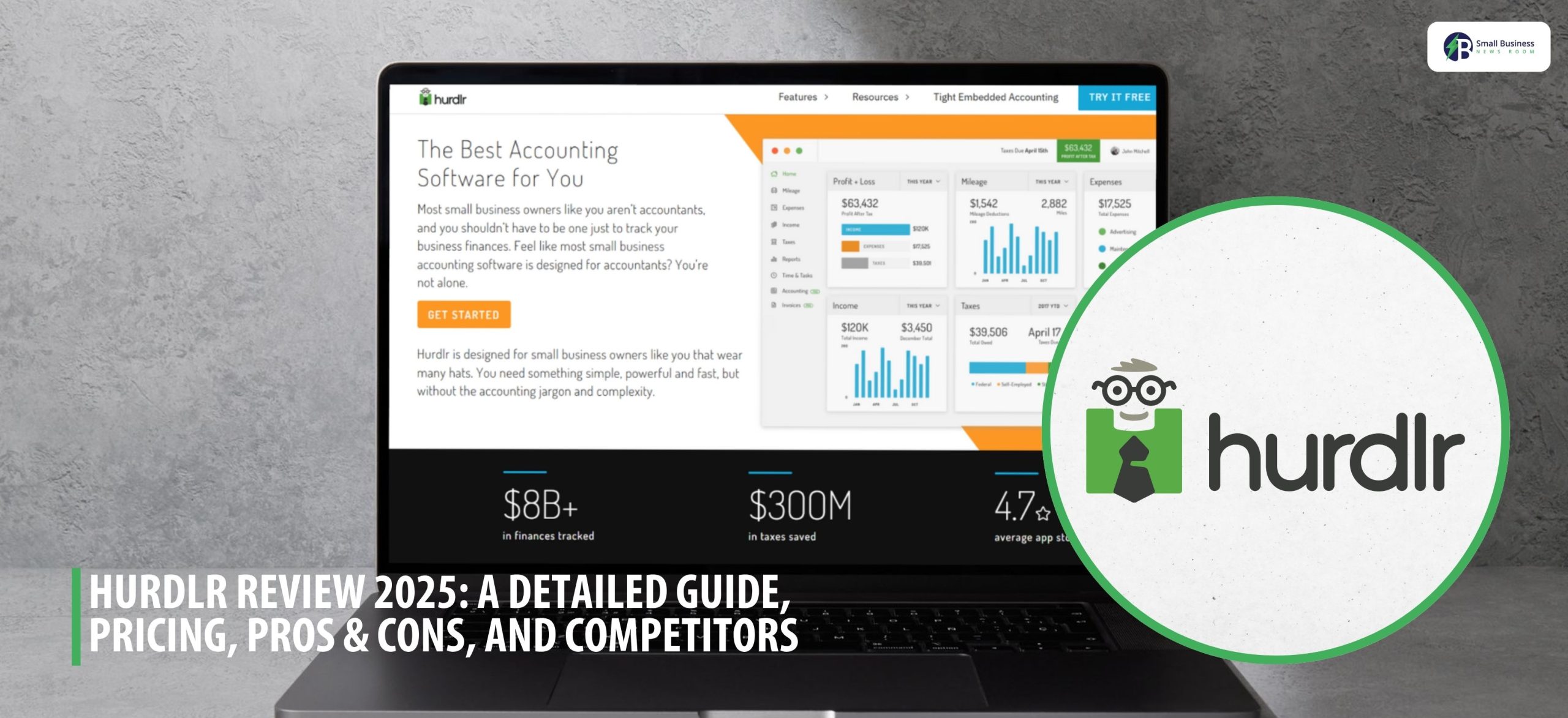

Hurdlr Review 2025: A Detailed Guide, Pricing, Pros & cons, and Competitors

Are you looking for a detailed review of Hurdlr? Then you have come to the right place. This article will discuss the platform and help workers, freelancers, and small business owners decide if it is the right choice!

We will also take a look at how the platform can help you manage expenses, track mileage, and further estimate taxes.

Read on to learn more!

What Is Hurdlr? A Quick Overview

Hurdlr is a tax and finance “super app” for freelancers, gig economy workers, side hustlers, and small business owners fed up with sloppy spreadsheets and time-consuming record-keeping.

Its magic ingredient? Making expense tracking, mileage logging, invoicing, and real-time tax estimate a one-tap experience.

This app has become a particular favourite over the years for Uber operators, consultants, makers, and anyone managing multiple revenue streams.

The key selling point? It’s a whole lot easier to optimize your tax deductions and remain penalty-free without the typical panic of paperwork.

If you drive for a living, invoice clients, or just want a good expense-tracking app, Hurdlr’s definitely worth serious consideration.

Regardless of where you work or where it takes you geographically, having your finances in check makes for enormous peace of mind.

Why It Matters In 2025?

The gig economy remains thriving, with an increasing number of individuals freelancing, driving for ride-sharing services, and running side gigs in the US and around the world.

But what about the tax aspect of this new work world? Still stressful, and still complicated. With tax authorities imposing new burdens on independent workers, automation software such as Hurdlr has become a necessity.

Apps such as this one enable you to have no nasty tax time surprises and take every possible step.

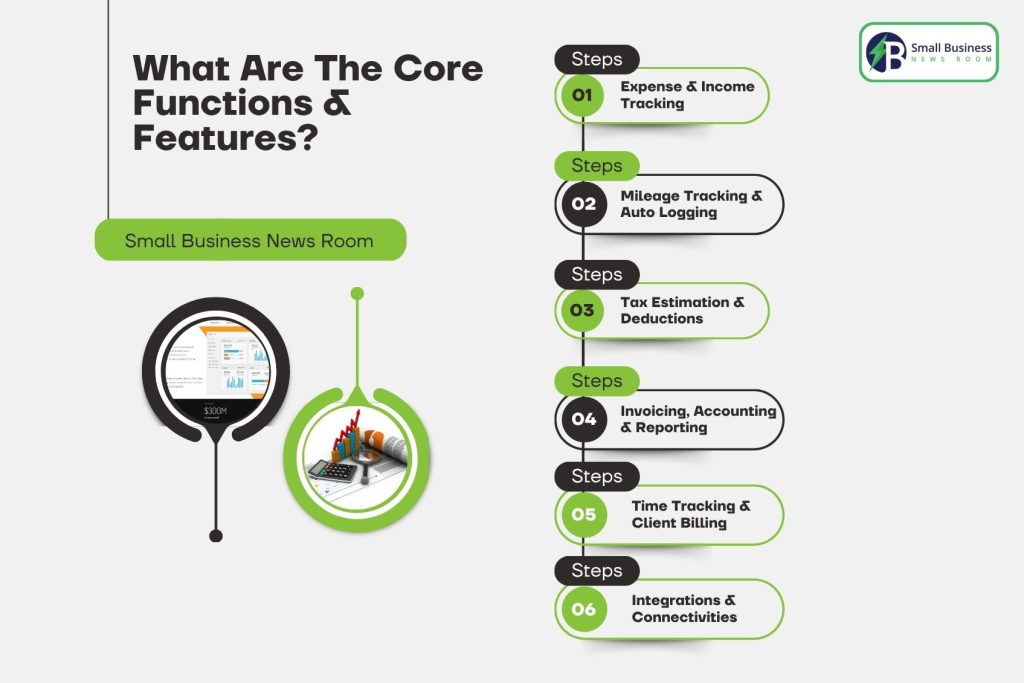

What Are The Core Functions & Features?

The key to the heart of this app is to get your financial life to feel in control, however chaotic it begins. Here’s a breakdown of what the app actually does for you:

Expense & Income Tracking

The application also keeps a tab of your expenditure and revenue for you by syncing to your business checking accounts or credit cards.

It categorizes all transactions for you automatically, aids in labeling every business or personal, and even lets you take receipt photos using the phone’s camera.

No need for scrambling for lost lunches or digging through statements.

If you’re a freelancer who gets paid through PayPal, Square, or even less common payment processors, Hurdlr tries to import those automatically, reducing the manual fuss.

It even suggests rules for recurring transactions, so your bookkeeping runs itself.

Mileage Tracking & Auto Logging

One of Hurdlr’s most prominent selling points is automatic mileage tracking. With a touch of the finger, this app can begin tracking all of your work miles that you drive! Think Uber rides, DoorDash driving, or real estate tours.

The app uses your phone’s GPS for automatic start/stop, but you can manually swipe to indicate whether the trip is business or personal.

If it happens to skip a trip or incorrectly logs the wrong address, it’s easy to correct by editing directly in the app.

The accuracy is generally good, but it has experienced mileage tracking glitches for some Android owners, especially when using selected phone models, so it pays to check your trip log once a week and manually adjust.

Tax Estimation & Deductions

Hurdlr excels in real-time intelligent tax estimation. As your expenses, mileage, and income fluctuate, the app continuously adjusts how much you owe, so you will no longer have a nasty surprise when it’s time for quarterly taxes.

The app is aware of current IRS mileage deduction rates and US self-employment tax formulas, and it will even remind you when deadlines are near.

Invoicing, Accounting & Reporting (Professional Tier)

Hurdlr Pro and Premium members have complete invoicing, customizable reports, ledgers, and a chart of accounts functionality, with the ability to print branded invoices, see who paid whom, and generate reports your accountant will adore.

Pro membership gives you even higher-level functionality for serious business owners, such as the general ledger, asset tracking, the possibility of having additional business entities, and complete US annual tax filing.

Time Tracking & Client Billing

The Pro level includes time tracking corresponding directly to your projects and clients, so that freelancers and consultants are able to create client-ready invoices at a line-by-line level, decreasing time spent disagreeing over billable hours.

Integrations & Connectivities

Hurdlr interfaces with large US banks through secure third-party connectors such as Plaid, and imports transactions from payment services such as PayPal, Stripe, Uber, Upwork, and others.

Data exports (CSV, PDF) are a snap for switching to a new accounting suite or for submitting neat reports to your accountant.

For the techies, the API for deep integration of your own business apps minimizes even the most convoluted workflows.

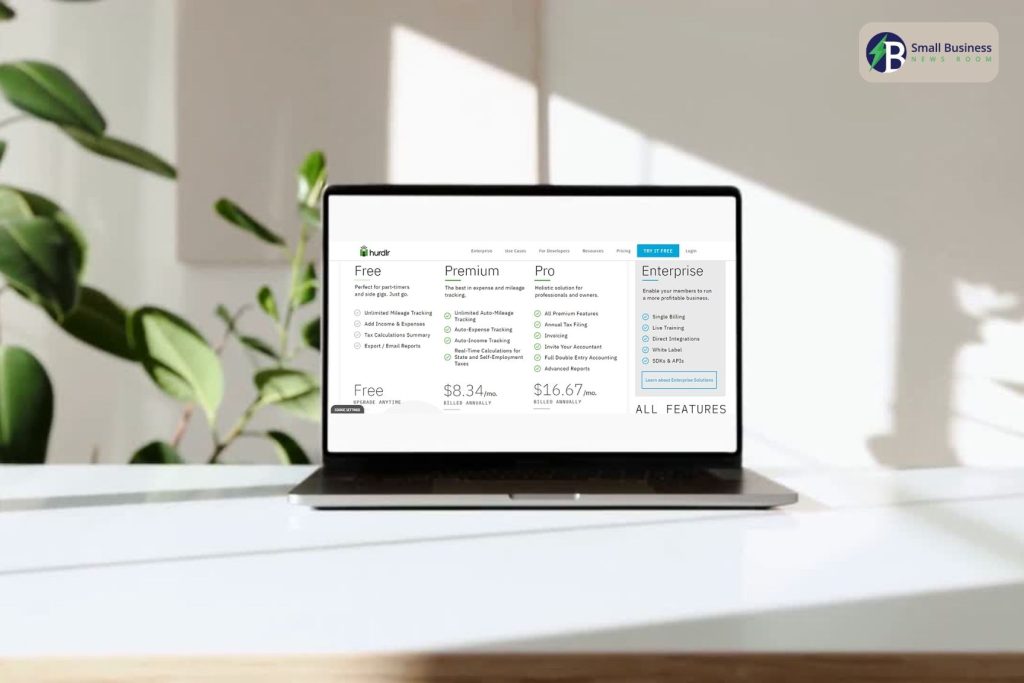

Hurdlr Pricing & Plans (Free, Premium, Pro, Enterprise)

Hurdlr’s cost is nicely straightforward, especially relative to the big accounting players. Here’s the breakdown as of 2025:

| Plan | Monthly Price | Annual Price | Expense & Mileage | Invoicing | Tax Estimates | Advanced Reporting | Bank Integrations |

|---|---|---|---|---|---|---|---|

| Free | $0 | $0 | Yes (manual, limited auto) | No | Basic | Limited | Some |

| Premium | $8–$10 | $100 | Yes | Yes | Detailed | Yes | Most major banks |

| Pro | n/a | $200 | Yes | Yes | US Tax Filing | Full journal, assets | All supported |

Setup fees do not exist, and neither do surprise fees, but enterprise customers will have to reach out to sales for business quotes. Note that usability and features are subject to change when Hurdlr revamps its plans.

Real‑User Feedback & Common Issues

Reliability is the consistency.

The Hurdlr app is prone to high ratings in recent user reviews thanks to its friendly dashboard, automation, and quick support. But every software has hiccups—let’s be realistic about the good and the bad.

What Users Like

➡️Extremely easy to install and maintain, even by non-accountants.

➡️Connecting banks, payment service providers, and gig apps is (typically) rapid and smooth.

➡️Automated mileage and tax tracking make expense reports child’s play.

➡️Invoicing programs are appropriate for most freelancers and small organizations.

➡️Helpful real-time tax estimation avoids ugly surprises at filing time.

What Users Complain About

Other users, particularly the Android users, experience bugs while tracking mileage—trips are not registered or addresses are imperfect.

Income tracking gets messy when you receive money from a variety of sources (Square, Stripe, and your bank), and it double-posts things that you have to remove manually.

Some connections sometimes become invalid after a system upgrade by a bank and need to be reconnected.

Refunds or cancellation procedures might take a long time, particularly when bought from mobile app stores.

All the features are available for the free version, and the Pro level is required for higher-level accounting.

Tips to Get the Best Experience

First things first, you have to religiously check your mileage log for omissions or errors, especially for Android phone users.

Secondly, you have to check your organized expenses. This way, you can finalize remittances from various sources each week. If the integration stops working, try reconnecting your bank or refreshing the app.

Employ manual overrides to correct split transactions or imported income that’s double-counted.

Always export a report backup prior to tax season, just in case!

Hurdlr vs Competitors

There are certainly a number of other mileage and cost-tracking programs available for download–how does Hurdlr stack up against the competition in the year 2025?

| Feature | Hurdlr | QuickBooks Self-Employed | MileIQ | Stride | Everlance | Zoho Expense |

|---|---|---|---|---|---|---|

| Automatic Mileage | Yes | Yes | Yes | Yes | Yes | Yes |

| Tax Calculation | Yes (real-time) | Yes | No | No | Yes (estimates) | Yes |

| Integrations | Banks, gig platforms | Banks, PayPal | No | No | Uber, Lyft | Most |

| Invoicing | Yes (Pro) | Yes | No | No | Yes | Yes |

| Multi-Currency | Yes (Premium/Pro) | No | No | No | No | Yes |

| Advanced Reports | Pro only | No | No | No | No | Yes |

| Price Range (Annual) | Free–$200 | $90–$180 | $60+ | Free | Free–$120 | Free–$360 |

Hurdlr wins outright on automation, total number of features, and transparent pricing, but some customers will need more integrations or better accounting in a different piece of software.

Is Hurdlr Safe & Reliable?

Security and privacy are valid issues for anyone linking sensitive financial information to an app. Fortunately, Hurdlr secures the keys to the castle with bank-level encryption in transit and when stored, and cooperates with reputable connection services (such as Plaid) to work through authentication.

For privacy geeks, Hurdlr makes its policy transparent by explaining where your data is stored, how long it’s retained, and how you can access it for removal whenever you want.

There’s no history of serious breaches that are publicly documented, and third-party app security testers have graded Hurdlr safe for business.

Protected API integrations mean your information is exchanged only when you instruct it. For UK/EU citizens, GDPR measures are implemented and in place at all times. Verify the most recent developments if non-US law holds any jurisdiction for you.

Advanced Use Cases & Scaling

While Hurdlr excels for solo operators, 2025 finds greater utilization by small shops, consultants serving several clients, and gig squads connecting under a single login.

Under the Pro plan, you’re able to work across several business entities, track various accounts, export bunched data, and even connect to bespoke apps using the API.

This allows you to export logs for audits, retrieve a CSV for your accountant, or set your books up for a transition to QuickBooks, Xero, or Zoho Expense.

If you are scaling from side hustle to agency, Hurdlr will keep pace, to a point. Ultra-complex organizations will need a real accounting suite anyway, particularly for payroll and deep audits.

How to Use Hurdlr Effectively?

To get the most out of Hurdlr, you can first classify all the transactions as business or personal after having imported them to maintain clean books. Once it is done, you can:

- Update your mileage once a week. You must review for overlooked trips and add them manually if required.

- Employ manual override for non-standard deductions and split payments. Photograph receipts the moment you’re paid and attach them in the app.

- Save monthly reports, especially before big deadlines or when you’re switching tools.

- Mileage logs and expense tracking are available worldwide for the otherwise top-notch Hurdlr US tax software.

Just keep in mind that tax formulas or the rate of deduction for your nation are different from those in the US, and work using exports and through a local accountant.

Is Hurdlr Right for You? The Final Words

Hurdlr precisely does what it claims: assist freelancers, gig workers, and small organizations to automatically track income, expenses, mileage, and tax.

If you happen to be US-based or gigging for companies like Uber, Lyft, or Upwork, it’s the coolest tool you’re likely to acquire.

Hurdlr is perfect if you need something stronger than a spreadsheet but less (and cheaper) than a complete accounting package.

It’s a very hard package to beat for the money that is, if automatic mileage and tax reminders are your number-one priority.

You might need mult-entity accounting or challenging payroll, or work has entailed tricky non-US tax jurisdiction; in that case, you can consider using Hurdlr along with a brand-name package or local guru.

Frequently Asked Questions

A: The starting price of Hurdlr is around $60 on an annual basis. There are different kinds of pricing plans, such as,

1. Hurdlr Premium: $ 60/Annually

2. Hurdlr Pro: $ 120/Annually

Apart from that, Hurdlr also provides a free trial to users.

A: The top 5 include:

1. Accounting

2. Banking integration

3. Budgeting integration

4. Expense management

5. Audit trial

A: Hurdlr can provide maximum support through phone, email, and training.

A: Hurdlr is commonly used for various purposes, such as expense management and more!