Table Of Contents

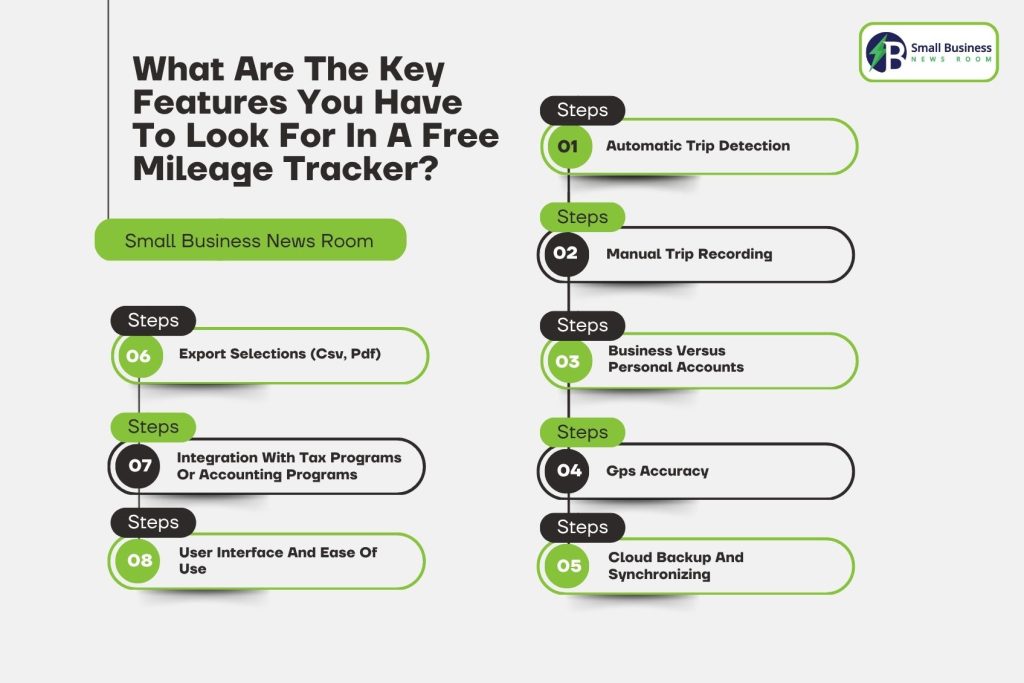

- What Are The Key Features You Have To Look For In A Free Mileage Tracker?

- Automatic Trip Detection

- Manual Trip Recording

- Business Versus Personal Accounts

- Gps Accuracy

- Cloud Backup And Synchronizing

- Export Selections (Csv, Pdf)

- Integration With Tax Programs Or Accounting Programs

- User Interface And Ease Of Use

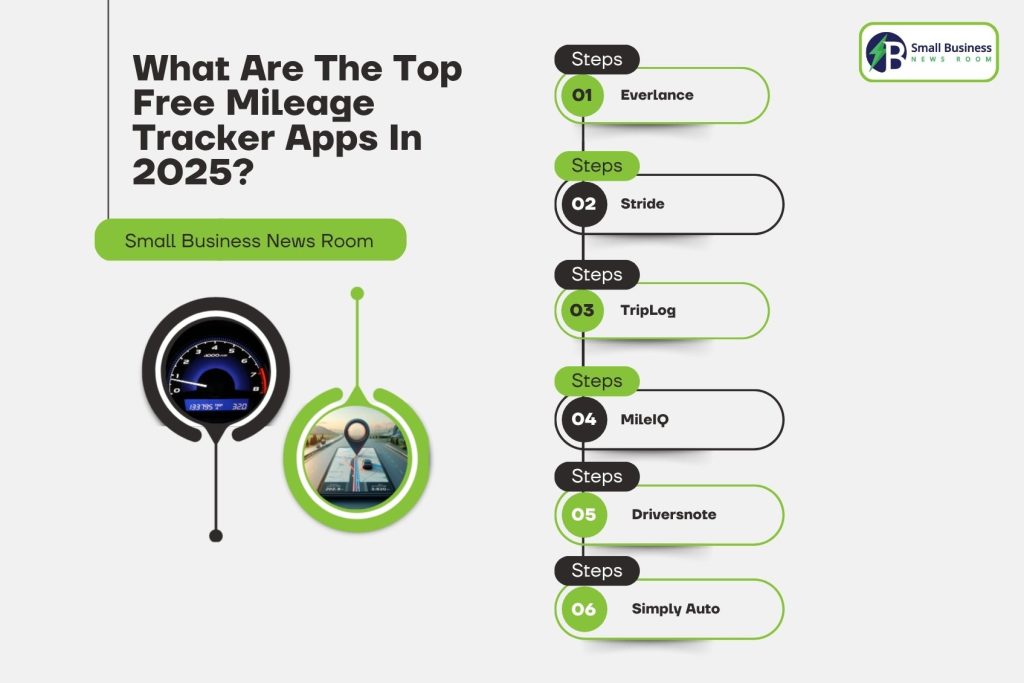

- What Are The Top Free Mileage Tracker Apps In 2025?

- Everlance

- Free versus Pay Features

- Accuracy & Battery Life

- Privacy/Offline features

- Best Use Case

- Stride

- Free versus Pay Features

- Accuracy & Battery Life

- Privacy/Offline features

- Best Use Case

- TripLog

- Free versus Pay Features

- Accuracy & Battery Consumption

- Privacy/Offline Features

- Ultimate Use Case

- MileIQ

- Free versus Pay Features

- Accuracy & Battery Life

- Privacy/Offline Features

- Best Use Case

- Driversnote

- Free versus Pay Features

- Accuracy and Battery Life

- Privacy/Offline Features

- Best Use Case

- Simply Auto

- Free versus Pay Features

- Accuracy and Battery Life

- Privacy/Offline features

- Comparison Table Of The Best Free Mileage Tracker Apps

- Use Cases: Which App Is Best For You?

- Best For Freelancers And Independent Workers – Stride

- Excellent For Business Owners – Triplog

- Best For Delivery Drivers – Everlance

- Best For Occasional Or Casual Drivers – Just Auto

- The Better For IRS Tax Deductions – MileiQ

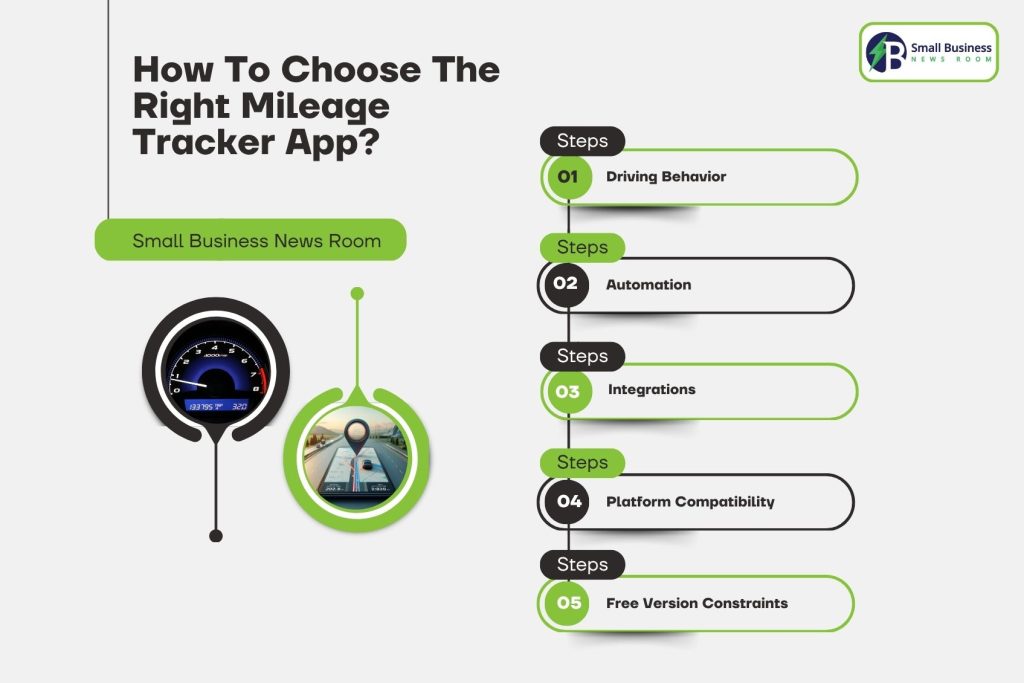

- How To Choose The Right Mileage Tracker App?

- What Are The Major Tips For Accurate Mileage Tracking?

- Frequently Asked Questions

Which Free Mileage Tracking App Is Right For You? Make An Informed Choice Today!

If you work as a driver, freelance, or own a business, calculating your mileage can be a challenge.

In such cases, the use of mileage tracker apps is particularly helpful. They will automatically log your voyages, estimate the distances, and provide the correct tax deductibles without the hassle of having all the details written down.

Mileage logging isn’t limited to business owners, it applies to delivery personnel, gig economy workers, and anyone looking to track fuel usage or handle reimbursement.

If you’re logging miles with the IRS, tracking client visits, or simply want to know more about your driving, the right app can streamline the process and ensure accuracy.

In this blog, I will discuss the best free mileage tracker app for 2025. It defines their key features, their user-friendliness, and their comparative standings. After reading, you will be able to tell the best app suitable for your driving purpose.

What Are The Key Features You Have To Look For In A Free Mileage Tracker?

When selecting a no-charge mileage tracker program, be sure that the one you pick will have the major features that you need!

Such as fast and easy log-in of trips and prep work for tax or reimbursement days. Some major features that you need to compare consist of:

Automatic Trip Detection

With the phone’s GPS, the feature automatically recognizes the beginning and end of the trip and logs the distance without the need for user input.

Certain apps allow you to define specific work hours so that the tracking can be done within business hours alone.

Manual Trip Recording

When you have not recorded a trip automatically or need to record a journey on a separate vehicle, the app will have you enter your trip data manually. In this manner, all of your traveling will be accounted for.

Business Versus Personal Accounts

The program must have an easy method of sorting journeys. Most programs utilize a straightforward system of swipes.

e.g., business-swipe right, personal-swipe left. This is very useful as it separates the miles that can be written off on the tax return and the personal usage miles.

Gps Accuracy

For a GPS to be reliable, it should be built into your phone and used for accurately tracking routes and distances.

The thing is that this will keep your logs accurate, so you will have no problems when tax season comes.

Cloud Backup And Synchronizing

With this feature, you can access your data from anywhere, at any time. This is because the data syncs automatically in the cloud, allowing you to access the data through a dashboard on the internet or via any device.

Export Selections (Csv, Pdf)

The software must be able to provide detailed reports and save them in multiple file formats, such as CSV (for spreadsheets) or PDF.

Reports are given for tax filing purposes or to provide to the employer in order to be reimbursed.

Integration With Tax Programs Or Accounting Programs

The best apps are the ones that interface well with popular accounting and taxation packages, like QuickBooks, Xero, or FreshBooks.

This further facilitates the process of handling money and can automatically incorporate your road trip into your calculation for taxation.

User Interface And Ease Of Use

An easy-to-use, simple, and clear app interface will be in the user’s favor, as the user will develop the habit, unconsciously, of frequently using the app.

The entire process of recording the mileage will be completed without disturbing or injuring the user. This is particularly significant in the case of individuals who use cars on a daily basis.

What Are The Top Free Mileage Tracker Apps In 2025?

Your choice of mileage tracker app depends on your own needs! Whether you need a simple GPS logging or a comprehensive financial management tool.

No worries! Here in this section, I am going to discuss the top 6 best free mileage tracker apps for you!

Everlance

Everlance is one such open-source mileage-tracking software developed with small businesses and independent contractors in mind.

It has auto-trip detection, expense tracking, and simple categorization. Unfortunately, the no-cost version will limit the number of automated trips you can track per month.

Free versus Pay Features

Free users can automatically track up to 30 trips each month, but paid plans do not have this limit and include advanced reporting features.

Accuracy & Battery Life

Users attest that the GPS is highly precise and consumes minimal battery, even when logging multiple short journeys.

Privacy/Offline features

Everlance ensures data is secure and automatically syncs when you reconnect to the internet, making it very useful for both offline and online tracking.

Best Use Case

Ideal for self-employed people and independent contractors who want easy, automated logging of mileage without too much hands-on activity.

Stride

Stride is completely free! You don’t have to opt for any upgrade plan. It will automatically track voyages, calculate the deduction, and provide an estimate of tax savings.

However, it is not directly integrated with bookkeeping software, such as QuickBooks.

Free versus Pay Features

The free version offers various core features, including a limited message history and file storage.

However, the paid version removes all of these restrictions and provides you with expanded storage along with a great user experience.

Accuracy & Battery Life

The GPS is reliable, but it will consume battery slightly quicker if you work long hours on the road each day.

Privacy/Offline features

Everything is kept confidential on your phone and syncs into the cloud when you go back online.

Best Use Case

Ideal for gig economy workers (Uber, Lyft, DoorDash) who need a no-fee, user-friendly app that simply keeps track of business miles.

TripLog

TripLog is renowned for its comprehensive reporting and adaptable tracking options. It is possible to utilize GPS auto-start, Bluetooth, or manually log trips. But the number of automated log trips is limited on the free plan.

Free versus Pay Features

Free users can track 40 trips automatically each month; premium plans provide unlimited trips, fuel tracking, and team management.

Accuracy & Battery Consumption

GPS works very well, but using GPS auto-tracking can make the battery last less.

Privacy/Offline Features

enables you to capture offline and syncs automatically when going back online.

Ultimate Use Case

Suitable for small business owners and sales teams that require detailed data and custom reports.

MileIQ

MileIQ is one of the original and most reliable mileage-tracking apps. It can automatically recognize trips and enables you to categorize them easily. Its chief drawback is that you can only have 40 free drives per month.

Free versus Pay Features

The free user is limited to drives. You can only take 40 trips per month if you plan to use the free version.

This can lead you to using the paid version, which provides unlimited tracking along with improved integration options.

Accuracy & Battery Life

Extremely accurate GPS that uses very little battery. This makes it ideal for day-to-day motorists.

Privacy/Offline Features

Your device stores trips. These are uploaded securely when you connect to the internet.

Best Use Case

The user experience is smooth. It is ideal for workers or professionals who demand precision, convenience, and dependability.

Driversnote

Driversnote is a logbook-like interface that is comprehensive and professionally done. It keeps track automatically and provides ready-to-file tax mileage reports. It has limited automated tracking on the free version.

Free versus Pay Features

The basic plan allows you to track up to 20 journeys per month. Premium plans provide unlimited tracking and include access to a Bluetooth tracker (iBeacon).

Accuracy and Battery Life

Excellent accuracy is achieved through sophisticated track modes, and low battery consumption is realized when automated detection is employed.

Privacy/Offline Features

Offline trip logging is supported, with secure syncing when online.

Best Use Case

Recommended for employees who need trip logs documented for reimbursement of gas or accommodation.

Simply Auto

Simply Auto is one such jack-of-all-trades app that not only keeps track of the servicing, fuel consumption, and mileage, but also the expenses. But the interface is too overwhelming on the first use.

Free versus Pay Features

The free plan includes basic mileage logging, while the premium plan unlocks auto-sync, trip classification, and unlimited vehicles.

Accuracy and Battery Life

Precise and consistent, although older handsets may experience tiny GPS holdups.

Privacy/Offline features

The app can function offline. Data is stored locally with optional cloud backup. The information is then securely backed up and synced to the cloud when an internet connection is available.

Best Use Case

Simply Auto is the perfect choice for car enthusiasts seeking a comprehensive tool to manage all aspects of their vehicle.

Comparison Table Of The Best Free Mileage Tracker Apps

For a freelancer worker or a small business, apps like Stride, Everlance, or Driversnote, the comparison table of the best free mileage tracker apps can help you make your decision!

| App Name | Auto Trip Detection | Free Trip Limit | Export Options | Integrations | Offline Tracking | Best For |

|---|---|---|---|---|---|---|

| Everlance | Yes | 30/month | CSV, PDF | QuickBooks, FreshBooks | Yes | Freelancers |

| Stride | Yes | Unlimited | CSV | None | Yes | Gig drivers |

| TripLog | Yes | Unlimited | CSV, PDF | QuickBooks, Xero | Yes | Small businesses |

| MileIQ | Yes | 40/month | QuickBooks | Yes | Business professionals | |

| Driversnote | Yes | 15/month | PDF, Excel | None | Yes | Employees |

| Simply Auto | Optional | Unlimited manual | CSV, PDF | Google Drive | Yes | Car owners |

Use Cases: Which App Is Best For You?

Finding the absolute free mileage tracker app isn’t necessarily about the features, either — it’s all about the compatibility of the app with your lifestyle.

If you work as a rideshare driver, own a small business, or simply need a tracking app for your own driving, these apps work well in your scenario.

Here is the definitive guide on how to pick the absolute best one that addresses your specific driving need:

Best For Freelancers And Independent Workers – Stride

Stride is totally free, fast, and easy. It’s ideal for gig drivers who must track every mile for tax deductions without worrying about app charges or complex setup.

Excellent For Business Owners – Triplog

TripLog offers helpful analytics, supports a wide range of vehicles, and integrates with QuickBooks and Xero. This makes it a great choice for entrepreneurs who manage multiple vehicles or teams.

Best For Delivery Drivers – Everlance

Everlance can help you with automated trip detection and one-click categorization. Busy delivery professionals can easily log all their trips with minimal battery usage.

Best For Occasional Or Casual Drivers – Just Auto

Simply Auto is a car management program. It keeps personal automobile owners on top of maintenance, fuel, and mileage.

The Better For IRS Tax Deductions – MileiQ

MileIQ has IRS-ready reports and unrivaled accuracy, which is why it is ideal for professionals who must make year-end tax filing a breeze.

How To Choose The Right Mileage Tracker App?

When selecting the perfect gas log tracker, consider how you drive, the level of automation you prefer, and what features you would like to synchronize. Other apps suit other individuals, so your own needs will be your compass.

Key points that need attention include:

Driving Behavior: A gig driver will have a right tracker app with special features designed specifically for them, whereas regular users will enjoy a one-click, one-app experience.

Automation: Select between “set-it-and-forget-it” convenience through automated GPS tracking or a more interactive approach.

Automatic tracking, running in the background, organizes drives through a one-second swipe.

Integrations: For making bookkeeping and taxation simple, check compatibility with such tools as TurboTax, QuickBooks, Xero, and others. It facilitates the easy exporting of reports that adhere to IRS guidelines.

Platform Compatibility: Ensure the app is compatible with your devices (iOS, Android, Web) so that you can easily track and report.

Free Version Constraints: Free versions of many apps impose constraints, such as a limited number of journeys per month that can be tracked.

Determine if a free plan is suitable or if you need to pay for unlimited monitoring and other advanced features.

The final best app is the one that integrates seamlessly with your workflow and provides accurate, compliant records for optimal tax deductions.

What Are The Major Tips For Accurate Mileage Tracking?

To access the high-quality free mile logging app, consider your driving conditions and the extent of assistance that you will require.

Verify Your Driving Behavior: If you commute daily as part of your work, consider using a fully automated tracker like Everlance or MileIQ.

Keep in Consideration the Level of Automation: manual-only software is fine for one-time use, but daily tasks require full automation.

Value of Integrations: If you use TurboTax or QuickBooks, choose an app like TripLog or Everlance that they support.

Platform Compatibility: Ensure the app is compatible with iOS, Android, and the web for seamless convenience.

Free versus Paid Constraints: Free plans often restrict the number of automated trips on the plan, so consider whether the upgrade is suitable for you.

Frequently Asked Questions

Yes, there are many apps that can offer you free versions with the core features like categorization and trip logging. However, some may have limitations on the number of trips.

Stride, Everlance and MileIQ are commonly recommended for the tax purposes due to their accurate tracking and IRS compliant reporting.

Yes! You just have to look for reputable mileage tracking apps. These apps mainly use data encryption and privacy controls. Also, always try to review the privacy policy before installing.

No! You just have to check if the app offers cloud syncing or backup (e.g., Everlance, Driversnote). You can log in to another device and restore your data.

Yes, almost all free mileage tracker apps offer manual logging if automatic tracking isn’t available or preferred.