Table Of Contents

- What is ExpensePoint?

- Core value proposition

- What Are The Main Features & Operations?

- Receipt Scanning / OCR / AI Parsing

- Card integration & auto matching

- Policy enforcement & fraud detection

- Workflow approval & report dashboards

- Mobile apps, mileage log, travel integration

- Multi-currency, multi-language, global support

- Security, compliance, audit trails

- What Are The Plans They Are Offering?

- What’s included vs add-ons

- Cost per user, scalability, total cost of ownership

- Are There Any Hidden Costs That Are Limiting Barriers?

- What Are The Strengths Of ExpensePoint?

- What Are The Major Weaknesses/Complaints?

- ExpensePoint vs Competitors

- When is ExpensePoint the right or wrong decision?

- Best Practices For Adoption And Implementation

- How To Plan Rollout

- Tips To Maximise ROI

- Common Errors And How To Avoid Them

- Verdict & Recommendation

- Frequently Asked Questions

How Can ExpensePoint Streamline Your Expense Management Process?

Managing staff spend is a top concern for organizations of all sizes, especially as they grow across borders and must maintain controls and compliance.

ExpensePoint is a solution for expense management that claims to automate and streamline this whole process, but does it really work across the board?

This guide goes beyond marketing and simple reviews, delving deep to provide a comprehensive understanding of ExpensePoint@!

I will help you to explore the factors, including its features, user stories, implementation recommendations, ROI analysis, pros and cons, and how it stacks up against competitors.

What is ExpensePoint?

ExpensePoint is a globally based enterprise specializing in expense management software, with a pedigree dating back over a decade, emphasizing expense automation for everything from small firms to multinationals.

Their credentials are reinforced by universally high user ratings and a tradition of great customer support.

The company has also moved toward cloud applications with a focus on simplicity, mobility, and global compliance.

Core value proposition

Whereas typical tools focus on manual handling or batch processing, ExpensePoint is dedicated to true automation, from receipt capture to policy enforcement.

They further expanded their services into tele-access and seamless integrations with accounting and ERP software.

Their key promise is less administrative work, enhanced financial control, and regulatory compliance.

It is designed to suit an array of requirements, be it a fast-growing SME, a non-profit organization, or a construction company.

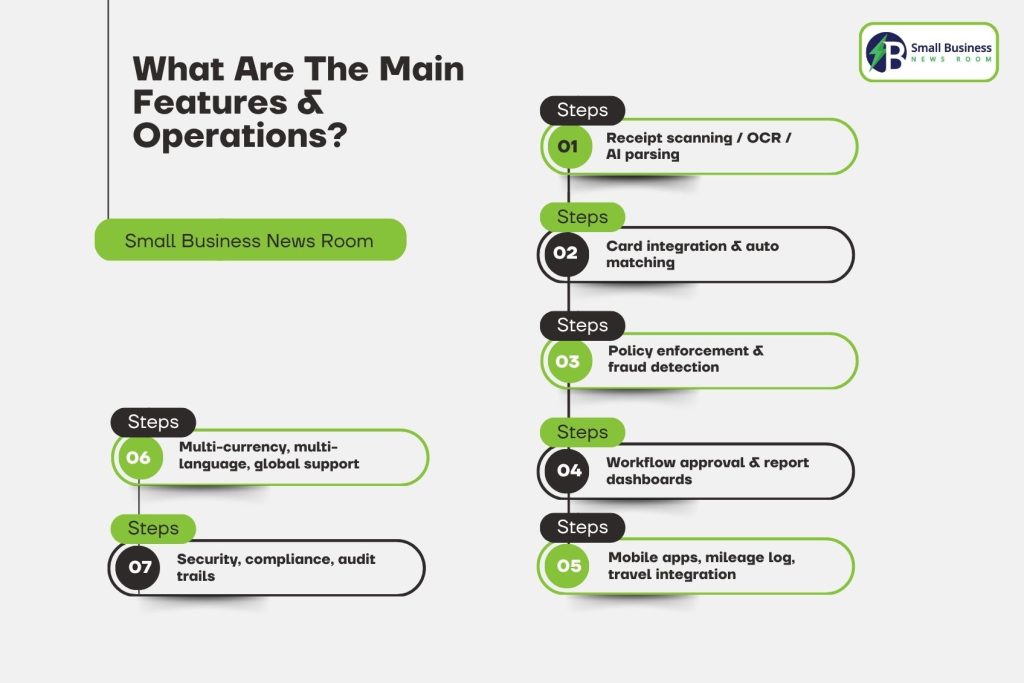

What Are The Main Features & Operations?

The platform is a cloud-based expense management software that automates the process of creating, submitting, and approving employee expense reports.

Its core operations rely on AI-powered automation and a configurable workflow to manage spending, ensure compliance, and streamline reimbursement.

Receipt Scanning / OCR / AI Parsing

ExpensePoint scans, categorizes, and automatically inputs receipt information with OCR and AI, reducing manual entry and errors.

User reviews find the receipt “Wallet” convenient, though it is occasionally buggy if the app freezes or experiences a receipt mismatch, suggesting a need for continuous AI accuracy enhancement.

Card integration & auto matching

Compatibility with key credit cards allows seamless download and automated association of transactions with the correct expense records, vastly accelerating reconciliation.

A minute minority of clients have had minor issues with American Express transaction syncing; otherwise, responses are positive, and this is a key value feature.

Policy enforcement & fraud detection

The platform also automates the enforcement of company policy while identifying potential fraudulent claims and out-of-policy spending.

This is key to compliance and reducing errors, with digital signatures and audit trails enhancing integrity for the finance teams. Customizable approval layers support provides detailed control.

Workflow approval & report dashboards

The platform offers flexible and customizable approval workflows, enabling companies to build multi-level sign-off structures tailored to their requirements.

Easily presented as user-friendly, its dashboards for reporting provide administrators with direct views into expense, trends, and anomaly activity.

Mobile apps, mileage log, travel integration

Mobile accessibility and mileage capture capability are at the heart of what the platform offers.

The user-friendly, well-thought-out mobile app is especially efficient for field crews. Offline capture of expenses and right-away receipt uploads are time savers.

On top of that, it also supports international capabilities and supports multiple languages to meet global requirements.

Multi-currency, multi-language, global support

ExpensePoint is designed with a multinational audience in mind, handling multi-country expense processing and supporting various languages.

This feature is very beneficial in distributed teams with many Asia-based, Europe-based, and Americas-based teams.

There are a few restrictions with the country-specific GST/VAT configurations, yet the support staff often assists organizations in customizing the setup.

Security, compliance, audit trails

The software is compliant with major data privacy and data security standards (SOC, PCI) that allow for data integrity and auditability.

Administrators appreciate the complete activity logs and audit trails that are essential for regulated environments and international accounting requirements.

What Are The Plans They Are Offering?

Pricing with ExpensePoint typically includes a per-user per-month fee, offering appropriate plans for smaller businesses and enterprise-ready solutions.

Pricing will depend on volume and feature requirements, but will be in line with other tools. Base packages typically include most standard features, while higher-end integrations or analytics are offered as paid add-ons.

What’s included vs add-ons

Core subscriptions have the workflow tools one needs, inbound receipt capture, policy enforcement, reporting, and ease of integration.

More advanced functions, such as custom dashboard configuration, API availability, and enterprise-compliance modules, are separately charged, so a detailed analysis of the comprehensive cost is required.

Cost per user, scalability, total cost of ownership

The platform embodies scalability, requiring companies to pay only for active users. Most companies achieve tremendous cost reduction compared to legacy systems.

The manuals have been helpful in streamlining the process. Training and configuration, though, have to be factored into any ROI study.

It starts at $10.50 per user per month. The software is available on a monthly subscription basis. The price starts from $5 per user for small businesses.

On the other hand, the large enterprises have around 1000 people, and the price can go down to $2 per user.

Are There Any Hidden Costs That Are Limiting Barriers?

A few users mention that in-depth customisations (beyond the out-of-the-box configuration) are dependent on support intervention or supplementary fees.

Like most SaaS, integration with a specific set of accounting or ERP programs can also have setup fees.

What Are The Strengths Of ExpensePoint?

The primary strength of the platform is its intuitive user experience, responsive support, and robust automation.

The users praised the user-friendly and straightforward design, which makes submitting and managing expenses.

The platform is also suitable for mobile applications. According to Capterra, ExpensePoint has an overall rating of 4.8 out of 5 stars.

Here’s what the customers are saying:

“ExpensePoint has been a great tool for our organization. The system is extremely user-friendly, making it very easy for employees to submit and manage their expenses. All the training materials provided are clear, well-structured, and easy to understand, which makes onboarding and learning the system very smooth…..”

“The ExpensePoint (EP) setup and support team is fantastic to work with. They are always available to help and provide support where needed……The platform is fairly intuitive, and the training provided by EP helped get our team up and running fast, learning the new system…..”

What Are The Major Weaknesses/Complaints?

There are also complaints about receipt matching issues or temporary app freezes, mostly on older phones.

Advanced customisation typically necessitates assistance from support teams, something that can hinder alterations.

Moreover, some account integrations (specifically with American Express) experience occasional syncing problems.

Lastly, editing or transferring cost prohibitions across reports is not allowed unless they are removed and re-uploaded.

ExpensePoint vs Competitors

So, what kind of companies would opt for substitutes? Big companies prefer Concur for its profound ERP integration and broad compliance, while micro-businesses favour Zoho Expense for its cost-effectiveness.

The high responsiveness and global flexibility of ThePla make it ideal for SMEs, non-profits, and teams with a regional distribution.

Expensify has been the strongest contender for businesses that are seeking the most reliable and user-friendly receipt-scanning technology. The platform can also provide you with 98.6% OCR accuracy.

| Tool | ExpensePoint | Expensify | Concur | Zoho Expense | Certify |

|---|---|---|---|---|---|

| User rating | 4.8/5 | 4.4/5 | 4.2/5 | 4.5/5 | 4.0/5 |

| Pricing | Competitive | Moderate | Higher | Low-moderate | Moderate |

| Mobile app | ✅ | ✅ | ✅ | ✅ | ✅ |

| Receipt OCR | ✅ | ✅ | ✅ | ✅ | ✅ |

| Best for | SMEs, global | SMBs | Enterprise | SMBs | Mid-size |

| Integration | Wide | Wide | Most ERP | Good | Good |

| Support | Highly rated | Average | Strong | Good | Average |

When is ExpensePoint the right or wrong decision?

The Platform is best suited for organisations that have distinct workflows, support for several countries, and quick implementation.

Organisations that are in need of full-blown customisation or complex account functionality may require expensive, highly configurable solutions.

Best Practices For Adoption And Implementation

The implementation of The Platform always requires a strategic approach. You just have to ensure that there is clear communication, a strong policy definition, as well as a technical rollout. Here’s how you can adopt and implement!

How To Plan Rollout

Phase the rollout! Pilot teams, face-to-face training, and funds dedicated to change management to promote adoption. Early user feedback identifies friction spots.

Tips To Maximise ROI

You can start by automating mileage and receipt capture whenever possible. You can also make explicit policies within the system for early exception flags.

Moreover, the use of reporting dashboards to support regular monthly reviews and accountability can play a huge role in maximising the ROI.

Common Errors And How To Avoid Them

Well, the over-customisation at introduction increases complexity and hinders adoption. Lack of proper training causes errors and rework.

Failure to have policies and integrations reviewed by local legal, tax, or compliance advisors can result in regulatory gaps.

Verdict & Recommendation

The Platform receives an A+ for usability, support, and automation, especially from small and mid-size organisations requiring a scalable, worldwide solution.

Simplicity, customising (with support), and great ROI through time saved are its main strengths.

Mid-size contractors, field service providers, and non-profits are good fits, but any growing business will want to have The Platform on its short list.

Areas for improvement are self-service customisation and even broader integration.

Frequently Asked Questions

ExpensePoint streamlines expense reporting with automated entry, OCR, and approval combined with AI-driven compliance.

Pricing is dependent on user count and feature set, with competitive per-user rates to begin with, and enterprise feature add-ons.

It also features receipt scanning, mobile applications, credit card handling, approval workflows, report customizability, and worldwide compliance solutions.

ExpensePoint is also synchronised with major accounting packages (QuickBooks, Xero, etc.) and supports wide API integrations with custom systems.

Yes, the mobile app is driver-focused and also provides both mileage capture and receipt capture offline.

Strengths: user-friendly, timely support, workflow automation.

Weaknesses: occasional app freeze, certain restrictions on self-service configurations.