Table Of Contents

- Tax calculator DoorDash: A Dasher's Complete Guide

- Here’s Everything You Need To Know About The DoorDash Taxes

- What Taxes Does DoorDash Pay?

- What Is The Purpose Of A Tax calculator DoorDash?

- But, How Does It Work?

- What You Will Need for Correct Calculations?

- Gross Earnings From DoorDash

- Deductible Business Costs

- Other Income Or Deductions

- Popular DoorDash Tax Calculators for 2025

- Stride

- Keeper's

- QuickBooks Self-E

- TurboTax Self-Employed Calculator

- Mobile Apps And Internet Tools

- How to Use a Tax calculator DoorDash Efficiently?

- Watch Your Spending Right Away

- Set Aside Taxes Weekly

- What Are The Common Mistakes That You Must Avoid?

- Not Paying Quarterly Taxes

- Forgetting About Deductions

- When To Use A Tax Specialist Instead?

- Hard Tax Cases

- Benefits Of Hiring A CPA Or Tax Advisor

- What Are The Simple Tips For Using A Doordash Tax Calculator?

- Frequently Asked Questions

How Can I Calculate My DoorDash Tax Liability? Use This 2025 Calculator

If you’re a DoorDash employee, then you’re familiar with your own sense of independence. Your hours are flexible, your pay is prompt, and your schedule is yours to choose and adjust as needed.

But, on its own, being your own boss also means being responsible, for the most part, for taxes.

Since DoorDash doesn’t deduct taxes from your payments, it’s your responsibility to figure it out and pay it yourself.

That’s where a DoorDash tax calculator becomes your new friend. It helps you to estimate your tax liability, budget, and avoid nasty shocks come April.

In this handbook, we explain how DoorDash taxes work, how to include things in your calculations for taxes, and which calculators to use to help calculate your 2025 tax liability accurately, all written in plain language.

Tax calculator DoorDash: A Dasher’s Complete Guide

So, what is a DoorDash tax calculator? The DoorDash tax calculator is a tool that estimates the taxes you owe as a DoorDash driver.

This is based on your income, mileage, and expenses. Because you are self-employed, your taxes are not withheld directly from your pay.

Having a calculator helps you figure out how much to budget for taxes for a year. That way, you won’t be pushed to pay a gigantic bill at some point in the future. It’s like having a mini budget assistant right next to you all of the time.

Here’s Everything You Need To Know About The DoorDash Taxes

DoorDash drivers are independent contractors, not employees. You’ll receive a 1099 form, not a W-2, and no taxes are withheld from your paychecks.

You are mandated to pay your self-employment tax, state tax, and your federal income tax. Your tax pays for your Social Security and Medicare contributions.

It’s a bit complicated-sounding at times, but if you understand how it works, it’s a lot less problematic to handle your taxes.

What Taxes Does DoorDash Pay?

This is a simple breakdown of what taxes Dashers usually pay:

- Federal income tax: As per your total income and tax bracket.

- Self-employment tax: 15.3% (includes Social Security and Medicare.

- State and local taxes: They depend on where you live.

If you are using a DoorDash tax calculator, ensure it provides state tax rates, as not all calculators do.

What Is The Purpose Of A Tax calculator DoorDash?

The function of a DoorDash tax calculator is simple! It is simply there to enable you to estimate your tax liability before it becomes payable.

This helps you see how much to save, plan payments every three months, and avoid any bad surprises when it’s time to pay taxes. It’s one of the simplest ways to stay organized and financially safe as a gig worker.

But, How Does It Work?

The Tax calculator DoorDash not only works for the employees but also for employers. Here’s what you can actually

- Total income from DoorDash

- Miles traveled for deliveries

- Expenses deductible (e.g., gas, toll, cell)

- Your state and filing status.

As you enter your information, it determines your annual total taxes. Some of them also display it by quarter and inform how much to pay each time.

Mind your step! And make sure that the numbers are correct! Actual taxes might be a tad different depending on your individual deductions or state requirements.

What You Will Need for Correct Calculations?

Dealing with numbers seems crazy! Always! But counting tax numbers, it’s even crazier!

To have your best outcome for your DoorDash tax calculator, you have to start collecting the following information before you start:

Gross Earnings From DoorDash

You’ll know how much money you made through your DoorDash app or on your 1099 statement. Be sure to list all of your pay and tip money. Be precise.

Deductible Business Costs

Deductions save you money. A few of your typical deductible expenses are mileage and fuel, car repair and upkeep, phone and data plans (for accessing DoorDash).

Additionally, tolls, parking, and delivery trucks are also included in this. These allowances lower your taxable income, so you pay less tax.

Other Income Or Deductions

If you work for other platforms, such as Uber Eats, Instacart, or Grubhub, you must also include your income earned from those platforms.

You may also include personal deductions like health insurance premiums or retirement contributions if permissible for you.

Popular DoorDash Tax Calculators for 2025

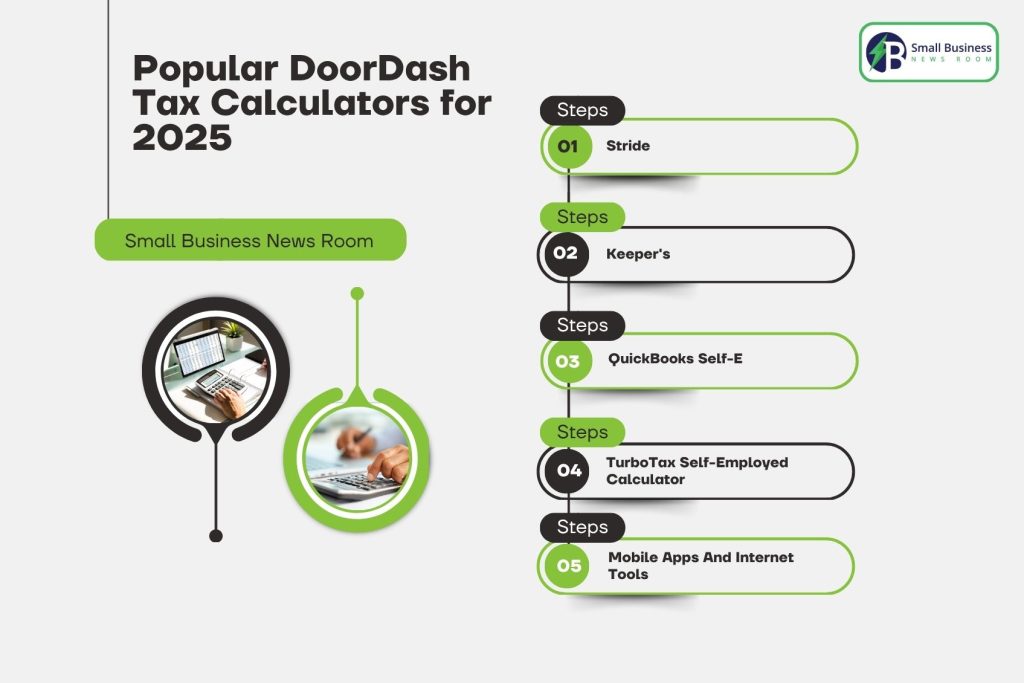

You don’t have to calculate numbers by hand. Here are some well-known tools that make figuring out taxes easy and stress-free:

Stride

Stride is a favorite among gig workers because it offers automatic mileage and expense tracking. It also provides speedy and precise tax estimates.

Keeper’s

Keeper reviews your banking transactions and finds available tax deductions for your benefit. It’s perfect for people who are looking for a smooth way of tracking their taxes.

QuickBooks Self-E

If you have multiple sources of income, then QuickBooks is a good choice. It connects to your accounts, tracks your income, and offers real-time tax estimates.

TurboTax Self-Employed Calculator

The TurboTax calculator is easy to use and suitable for beginners. It provides your total as well as quarterly tax estimates instantly.

Mobile Apps And Internet Tools

Web calculators are suitable for rough estimates, but cell phones are convenient for constant record-keeping.

If you wish to manage your taxes efficiently, cell phone programs such as Stride or Keeper enable you to record mileage and expenses automatically as you go about your work daily.

How to Use a Tax calculator DoorDash Efficiently?

It is easy to work a calculator, but working it efficiently is a great difference maker. Here’s how to work it efficiently:

Watch Your Spending Right Away

Do not wait till tax season to total your receipts. Utilize expense and mileage-tracking programs like Everlance or Stride. The better your expense records, the better your tax estimate.

Set Aside Taxes Weekly

Avoid year-end stress by budgeting regularly for your tax payments. As your calculator’s forecast suggests, allocate about 20–30% of your weekly income for tax payments. Budgeting regularly maintains your finances stable and prepared for quarterly settlements.

What Are The Common Mistakes That You Must Avoid?

Even savvy Dashers make missteps when it comes to taxes. Here are some common errors to keep an eye out for:

Not Paying Quarterly Taxes

If you expect to owe more than $1,000 for the year, the IRS asks for quarterly payments from you.

Once you fail to pay by the deadline, you might have to face the penalties. So, use your calculator to calculate how much you pay each quarter, and mark the due payment dates on your calendar.

Forgetting About Deductions

You should not overlook minor deductions, such as car maintenance, depreciation, or delivery accessories. They add up and lower your overall tax burden significantly.

When To Use A Tax Specialist Instead?

The Tax calculator DoorDash is suitable for a rough estimate. Still, if your situation is complex, with multiple income sources, substantial deductions, or state-level requirements, it’s advisable to consult a professional.

Hard Tax Cases

If you have multiple sources of income to bring home, or if you’ve earned a substantial amount of money delivering for DoorDash, consulting with a CPA may help prevent costly mistakes.

Benefits Of Hiring A CPA Or Tax Advisor

You can hire a tax specialist to give you maximum deductions, ensure your papers are submitted accurately, and provide reassurance. Just imagine calculators as your assistant and a CPA as your backup solution.

What Are The Simple Tips For Using A Doordash Tax Calculator?

As a Dasher, if you plan to save a substantial amount of money, using a DoorDash tax calculator is a financially savvy move.

However, it must be used appropriately to yield precise results.

You can start by selecting a calculator designed for gig workers. This can include Stride, Keeper, or TurboTax Self-Employed. They are designed to meet the specific tax needs of your delivery driver.

Always input your entire gross income directly from your DoorDash 1099 statements or app reports, so your outcomes are accurate.

Then, log every mile you travel for deliveries. You’ll pay $0.70 per mile for deliveries for driving your own vehicle, as per the IRS standard mileage for 2025, and your taxable income may fall significantly lower.

Document all legitimate business expenses, including gas, toll, phone expenses, and delivery equipment like hot bags.

Don’t be dishonest about your deductions; claiming personal expenses are business expenses may raise a red flag for the IRS.

Do not overlook the self-employment tax (15.3%) when calculating how much is owed. Check your taxes monthly or if your income changes to stay current.

Third, use the calculator to help budget quarterly tax payments and set aside approximately 20–30% of your income for taxes.

Keep good records, including receipts and mileage records. Calculators don’t keep substantiation, but the IRS may request it at some point.

Frequently Asked Questions

A 1099 form is specifically issued to independent contractors, freelancers, and individuals who primarily receive income outside traditional employment.

Yes. Since DoorDash doesn’t withhold taxes, a calculator helps budget and avoid penalties.

Total income, business mileage, expenses, marital filing, and state.

You’re allowed to deduct $0.70 per mile for 2025 by IRS regulation, a huge money-saver for Dashers.

Yes, calculators usually include the self-employment tax of 15.3%.

Absolutely. Almost all calculators approximate the quarterly payment amount.

In fact, as a 1099 contractor, you yourself pay your own Social Security, Medicare, and income taxes.

Some calculators enable state-level estimates; don’t assume.

Mileage, gas, phone use, parking, tolls, and delivery equipment, part of your health insurance.

No, calculators are great for rough estimates, but a CPA provides accurate, compliant filing.