Table Of Contents

- How Much Do DoorDash Drivers Make?

- Can A Driver Choose When DoorDash Pays Them?

- What Is DoorDash Tax?

- How Many DoorDash Forms Are There?

- Your DoorDash Income

- DoorDash Tax Deductions That You Must Know About!

- How Can You Make The Quarterly Estimation Of The Tax Payments?

- How Much Do DoorDash Drivers Pay In Taxes?

How Do I Get My 1099 From DoorDash In 2025?

DoorDash drivers have this one liberty. They can either work so much or a little! Just the way they want! This gives them control over their own schedule. But? This also means that there is no limit to the overall earning potential.

While the scenario can be pretty exciting, there is one thing that is much more complicated for the DoorDash drivers than anyone else, the DoorDash 1099 form!

For a DoorDash employee, tax time is confusing, particularly when trying to obtain your 1099 form.

Don’t panic! Many Dashers have the same question every year: “How do i get my 1099 from DoorDash?”. Within this guide, we will break down how to obtain your 1099 through DoorDash, what the form is, and all of the other necessary information regarding taxes and being a DoorDash driver.

Let’s break it down in easy-to-understand terms for your understanding.

How Much Do DoorDash Drivers Make?

Before discussing “how do I get my 1099 from DoorDash”, let’s touch on earnings. How much money you bring in as a DoorDash driver depends on how often and how many trips you make. There is no salary; however, earnings are paid on:

Base Pay: An agreed amount for each delivery.

Promotions: Extra cash earned by doing special tasks or covering at busy times.

Customer Advice: 100% of tips go to you.

Some part-time Dashers earn a few hundred dollars a month while full-time drivers earn in the thousands. Keep in mind, though, that bigger pay requires bigger tax.

Usually, DoorDash says that the drivers typically earn around $15 to $25 per hour. This includes the customer tips in it.

However, the rate solely depends on the time of the day, the location where you are operating, and the number of deliveries that you have completed.

Can A Driver Choose When DoorDash Pays Them?

There is no typical paycheck system. DoorDash makes most of the payment through direct deposit.

However, if you need your earnings sooner, you can easily choose the FastPay option. This can help you to get paid a small fee once a day.

Other than that, you have DasherDirect. This helps you to receive an instant deposits without any fee.

What Is DoorDash Tax?

DoorDash is not like a regular employee to you. Instead, it treats you like an independent contractor. That means:

You are not issued a W-2 like other employees.

DoorDash takes no withholdings on what it pays.

They are mandated to report and pay income in their personal capacity. This means that whenever you bring in an order, you’re essentially a small business owner.

How Many DoorDash Forms Are There?

If you are self-employed, in that case, you are a sole proprietor by default, and this includes the DoorDash drivers as well.

This is the reason why you have to file your own taxes. You have to pay hundreds of dollars and do a lot of paperwork when it is necessary.

Around tax time, you might be asking what forms are required. Here is a concise list:

Form 1099-NEC: This is the important one. This form reports how much money you earned from DoorDash if you earned over $600 in a calendar year.

Schedule C: This is where the income and expenses of your business are listed.

Schedule SE: This is used to determine self-employment income, like Social Security and Medicare.

If you make less than $600, DoorDash will likely never send you a 1099 form, but you will still need to report income to the IRS.

Your DoorDash Income

Everything you earn, from income-based pay to promotions and tips, all of them constitute business income. The good thing is that DoorDash simplifies keeping track of this.

Here’s how you can keep track of it!

Open the Dasher app and then open up “Earnings” on the app to view earnings.

DoorDash will be sending 1099 forms through Stripe. If you made more than $600, then by December 31 (typically) you will be sent an email to open up a Stripe Express account.

After that, you can get your DoorDash 1099 form. Here you will be issued your electronic 1099-NEC by January 31.

If Stripe is not activated, a standard paper copy will be sent to you by DoorDash, but mit ight take longer.

Pro tip: Check your January spam and email folder so you won’t miss the Stripe invite.

DoorDash Tax Deductions That You Must Know About!

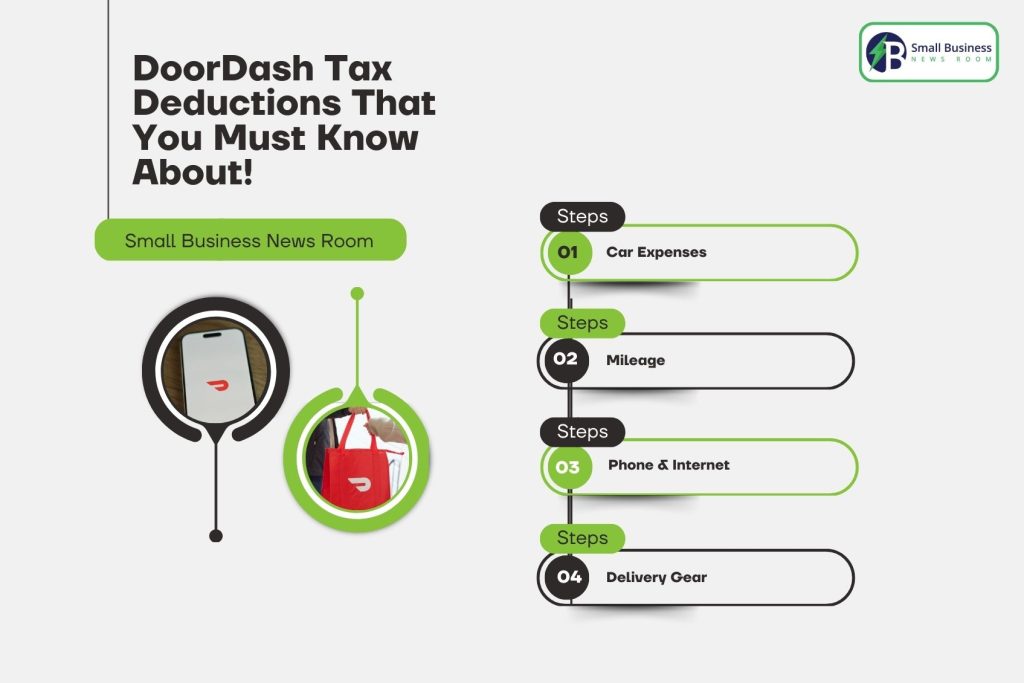

This is the best part: you do not pay tax on all of your income. You are allowed to deduct some business expenses to reduce taxable income. Regular Dashers’ deductions include car expenses, mileage, phone, internet, and many more!

Don’t worry! I will provide you with a detailed overview of it!

Car Expenses: The gas, the repairs and maintenance, insurance, and even sometimes a part of your car payments.

Mileage: Instead of tracking actual expenses, you can deduct an ordinary amount (67 cents per mile in 2024).

Phone & Internet: You can use part of your phone bill if you use it for DoorDash deliveries.

Delivery Gear: Containers, coolers, or whatever it is you transport goods in.

It is necessary to track these deductions. You just have to save receipts or use a mileage tracker to ease tax time.

How Can You Make The Quarterly Estimation Of The Tax Payments?

Since DoorDash itself will not withhold taxes from your income directly, you might be obligated to make estimated payments every three months to avoid penalties. The IRS wants payments on the following dates:

- April 15th

- June 15th

- September 15th

- January 15th of the coming year

You don’t have to calculate your taxes exactly—just pay at least 90% of what you owe or 100% of last year’s tax amount to be safe.

How Much Do DoorDash Drivers Pay In Taxes?

Your tax rate depends on how much income you earn, but the majority of Dashers pay two key taxes:

Income Tax: According to how much you earn after deductions.

Self-Employment Tax: This is Social Security and Medicare (approximately 15.3% of your net earnings).

If you earned $20,000 after deductions, then income tax and self-employment tax would be paid by you on that income.