Table Of Contents

- What Is Capital Budgeting?

- Goals Of Capital Budgeting

- Operational vs. Capital Budgeting

- The Step-By-Step Process

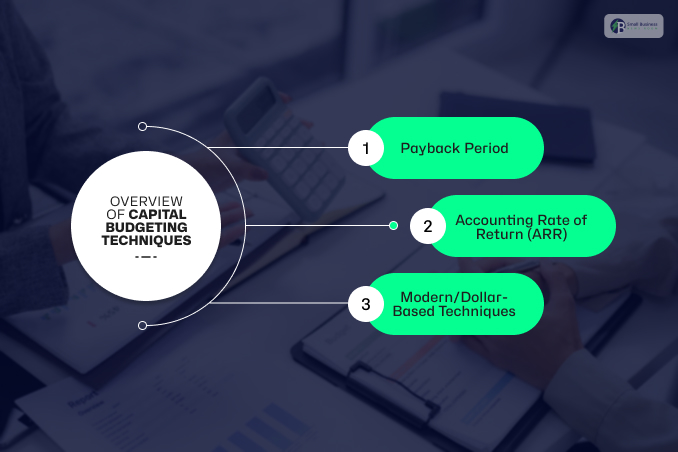

- Overview Of Capital Budgeting Techniques

- 1. Payback Period

- 2. Accounting Rate Of Return (ARR)

- 3. Modern/Dollar-Based Techniques

- 1. Net Present Value (NPV)

- 2. Internal Rate Of Return (IRR)

- 3. Discounted Payback Period

- 4. Profitability Index (PI)

- 5. Modified Internal Rate Of Return (MIRR)

- 6. Advanced Techniques

- How To Choose The Right Technique?

- Manufacturing Expansion

- Liquidity Priority

- Capital Rationing

- Top 10 Principles For Effective Capital Budgeting

- Practical Tips & Best Practices

- Avoid Single Approaches

- Consider Uncertainty

- Be Consistent And Realistic

- Go Beyond Numbers

Ultimate Guide To Capital Budgeting Techniques (NPV, IRR, Payback & Beyond) — Methods, Examples & Best Practices

Whenever a business decides to buy a new factory or maybe launch a new product line, it is not just all about spending money!

It is all about making a high-stakes bet on the future. This process is strongly known as capital budgeting.

You can call it a roadmap that companies use to decide which long-term projects are worth the investment!

One investment decision involves millions of dollars and years of commitment. Thus, it is necessary to get the math right! It is crucial for long-term success.

At the core of all capital budgeting techniques is the Time Value of Money (TVM). This TVM is a simple idea that a dollar today is worth more than a dollar tomorrow. Businesses use this principle to discount all future profits and determine their value today!

In this guide, we will explore some of the most common capital budgeting methods used by financial experts.

This would include traditional methods, such as the payback period, and advanced business investment evaluation tools, such as Net Present Value (NPV) and the Internal Rate of Return (IRR).

So, you will learn how to use specific project ranking criteria to select the best opportunities and ensure that every dollar you spend is well invested.

You will learn how to use specific project ranking criteria to select the best opportunities and ensure every dollar spent is well invested.

What Is Capital Budgeting?

At its simplest, the concept of capital budgeting is the process that a company uses to plan and manage its “big ticket” spending.

While daily expenses, such as office supplies and electricity, are important, capital budgeting focuses on major, long-term investments!

This includes building a new factory, buying expensive machinery, or launching a massive new product line.

It is essentially a financial roadmap used to decide if a project is worth the time, money, and risk.

Goals Of Capital Budgeting

Businesses do not just guess where to spend their money. They use this process to hit three specific main targets.

- Maximise Shareholder Value: The top priority is to select projects that increase the company’s overall value. This, in turn, can benefit the owners and shareholders.

- Effective Capital Allocation: Since no company has unlimited funds, capital budgeting ensures that limited resources are allocated to the most profitable opportunities.

- Risk assessment: Every big investment is a gamble. The process helps managers consider “what could go wrong” before they commit millions of dollars.

Operational vs. Capital Budgeting

Now, it is easy to confuse these two. However, they can serve different purposes.

- Operational budgeting: This focuses primarily on the short term and covers day-to-day costs, such as rent and payroll.

- Capital Budgeting: On the other hand, capital budgeting focuses on the long term and, moreover, covers large, infrequent investments that can shape the company’s future growth.

The Step-By-Step Process

To make a smart decision, businesses typically follow this specific flow:

- Identify opportunities: Find potential projects that align with the company’s strategy.

- Estimate cash flows: Always predict exactly how much money will flow in and out over the project’s life.

- Evaluate: Use methods such as NPV and IRR to determine whether the project is financially viable.

- Select: Always pick the best project, which is based on the data and available funds.

- Implement & Monitor: Start the project and keep a close eye on the actual results to ensure it stays on track.

Overview Of Capital Budgeting Techniques

Not all financial tools are high-tech. Businesses, when evaluating projects, often begin with “traditional” and simple non-discounting methods.

Such methods are pretty straightforward. Hence, they do not require complicated calculations of interest rates or inflation.

They are an excellent choice for a quick “back-of-the-envelope” calculation. This way, you can decide whether a concept warrants further consideration.

1. Payback Period

The Payback Period is probably the most straightforward way to gauge an investment. It simply informs you of the duration required for the return of your initial money.

Formula: Payback period = Initial Investment Annual Cash Inflow

Example: Suppose you invest $ 100,000 in a new machine that saves $25,000 annually; then your payback period will be 4 years.

- Pros: The method is very simple and emphasizes liquidity (how quickly you get your cash back).

- Cons: This method does not consider the “Time Value of Money” or any earnings generated after the payback period.

2. Accounting Rate Of Return (ARR)

In contrast to the payback method, which is cash-focused, ARR considers accounting profits. It determines the annual average percentage return over the project lifetime.

How it is used: Managers are fond of it because it incorporates figures that are already part of the financial statements (e.g., net income), so it’s easy to convey to shareholders.

Restrictions: Because it focuses on “book profit” rather than the cash available, it can be deceptive.

Apart from that, it does not take into account when those profits will be realized.

3. Modern/Dollar-Based Techniques

Traditional approaches are fine for quick assessments, but usually they overlook one crucial aspect: money now is more valuable than money later.

Newer methods involve discounting to account for interest and risk. These are the major tools used by seasoned analysts to make final decisions.

1. Net Present Value (NPV)

NPV is often considered the most reliable tool in capital budgeting. It determines the net present value of cash inflows and outflows.

Formula: t=0nRt(1+i)t

Practical Example: A new machine, for instance, costs $50, 000. It is going to make $20, 000 a year for three years.

If you apply a discount rate of 10%, the present value of those flows is approximately $49, 737.

As the cost ($ 50,000) exceeds the value created, the NPV is $263. You should decline this project.

- Pros: It is the most trustworthy yardstick for project performance, as it incorporates the time value of money and project risk.

- Cons: On the other hand, for it to function correctly, an extremely precise “discount rate” is necessary.

2. Internal Rate Of Return (IRR)

The IRR is the “break-even” interest rate. It is the specific percentage rate that makes the NPV of a project exactly zero.

Formula: Set 𝑁𝑃𝑉=0 and solve for r in: t=1TCt(1+IRR)t

Here: Ct= Net Cash inflow during the period t

C0= Total initial investment costs

IRR= The internal rate of return

t= The number of time periods

- Pros: The main advantage lies in the simplicity with which one can compare it to a company’s “hurdle rate” (for instance, “This project yields 15%, but our requirement is 12%”).

- Cons: The major drawback is the reinvestment assumption: IRR assumes you can reinvest your earnings at the same high rate, which is not always feasible in practice.

Several projects with unusual cash flows may also have “multiple IRRs, ” which in turn can be puzzling.

3. Discounted Payback Period

This method is simply a more intelligent one than the traditional payback method. It still poses the question, “How long will it take for me to recoup my money?”, but it first discounts the cash flows.

- Pros: Compared with the simple payback period, it provides a more accurate risk evaluation by accounting for the time value of money.

- Cons: Nevertheless, similarly to the original, it still disregards any cash flows that occur after you have reached the break-even point.

4. Profitability Index (PI)

The PI is a ratio used to rank projects when budgets are tight (capital rationing). It tells you exactly how much value you get for every dollar spent.

Formula: PI=Present Value of Future Cash FlowsInitial Investment

Example: A PI of 1.2 means for every $1 you invest, you create $1.20 in value. Anything over 1.0 is a “go.”

5. Modified Internal Rate Of Return (MIRR)

MIRR corrects the most important weakness of the traditional IRR calculation method. The assumption is that the positive cash flows are reinvested at the cost of capital (a reasonable rate) rather than at the project’s IRR.

This provides a more accurate estimate of the project’s actual return.

6. Advanced Techniques

In more complicated situations, basic formulas are no longer sufficient. Finance experts apply the following advanced techniques:

- Real Options Analysis

Analyzes a project as if it were an option. It considers the option value of flexibility, such as the option to expand if successful or to close down if failed.

- Equivalent Annual Cost (EAC)

Applied when comparing two different machines with different useful lives (e.g., Machine A has a 3-year life, Machine B has a 7-year life). It calculates the annual cost of each machine so you can compare them.

- Replacement Chain (EAA)

Similar to EAC, but it assumes that you replace the shorter project repeatedly until it equals the longer one.

How To Choose The Right Technique?

The choice of the right technique solely depends on your specific business goals. There are many tools available in the marketplace. However, most managers prefer to follow these simple decision rules:

- If the NPV is positive, the project can add value.

- If the IRR is higher than the borrowing costs, the return is worth the risk.

However, the best method usually depends on your situation, such as:

Manufacturing Expansion

For the big moves, such as building a new plant, using NPv or MIRR. These can give you the most accurate long-term picture for the wealth creation.

Liquidity Priority

If you are a startup or maybe low on cash, you can use the payback period. This specifically prioritizes getting your money back as quickly as possible so that you can pay your bills.

Capital Rationing

If you have a very strict budget, and you can only pick a few projects from the long list, you can use the Profitability Index, or PI, just to check which one gives you the most bang for your buck!

Once you can successfully match the technique with your needs, it becomes easier to ensure that your capital is working well! Just as hard as possible for your business.

Top 10 Principles For Effective Capital Budgeting

Smart, long-term investment decisions are the key to a business’s success. Effective capital budgeting ensures that large investments are aligned with the company’s mission and financial objectives.

Here are 10 easy and straightforward guidelines to ensure that capital budgeting is done correctly:

- Stick to Your Strategy: Ensure all investments align with the company’s overall strategy.

- Size Up the Risk: Don’t just look at the potential returns; also assess the risk associated with each investment.

- Remember Time Value: Use discounting techniques (such as NPV) because money today is worth more than money tomorrow.

- Know Your Borrowing Cost: Use your cost of capital as the benchmark for project returns.

- Focus on Cash In/Out: Make decisions based on actual cash flow, not just accounting profits.

- See the Big Picture: Think about how a new investment might impact other areas of the business.

- Be Flexible (Real Options): Consider the value of flexibility in future investments—to expand, contract, or walk away if necessary.

- Test the Limits (Sensitivity Analysis): Consider how the investment will perform if key assumptions (e.g., sales or expenses) change.

- Prioritize Spending: When money is limited, rank investments and allocate funds to those that yield the highest returns.

- Keep Watch: After an investment is made, monitor its performance and make adjustments if it goes off track.

Also Check: Why IUL Is A Bad Investment: The Financial Risks Of IUL

Practical Tips & Best Practices

But to make good investment decisions, formulas alone are not sufficient. Intelligent managers combine formulas with common sense. Here are some easy best practices for budgeting investments:

Avoid Single Approaches

Avoid making decisions based on a single criterion (such as Payback Period) or even NPV. Instead, use multiple approaches.

For example, a project may have a short payback period but a low NPV. Then you have to weigh the importance of speed versus value.

Consider Uncertainty

The future is uncertain. Perform sensitivity analysis and scenario planning to assess how your project will perform if sales decline by 10% or if unexpected costs increase.

This will prepare you for different risk scenarios.

Be Consistent And Realistic

Apply the same discount rate to all projects with similar risk. But most importantly, be realistic (and tough) in your forecast of cash flows.

Overly optimistic forecasts have derailed more projects than poor formulas.

Go Beyond Numbers

Numbers are not the only thing that matters. Consider other factors, such as how well a project aligns with your company’s core business strategy or its ESG performance.

In some cases, the best project may not be the one with the highest NPV. However, the one that aligns with your company’s long-term strategy.