Table Of Contents

- IUL Cash Value Is A Supercharged Savings Account

- Can IUL Work For Infinite Banking?

- Why IUL Is A Bad Investment? The Reasons

- IUL Issue 1: Your Premiums Are Subject To Significant Added Fees By The IUL Company

- IUL Issue 2: High Payment Amount For IUL Premium

- IUL Issue 3: It Is Hard To Get Out Of An IUL

- Is IUL A Good Or A Bad Investment For Retirement?

- IUL Acting As A Retirement Risk Buffer

- IUL Acting As A Better Proxy For Bonds

- IUL Acting As A Tax Shelter

- Why You Must Sue A Company That Sells IULs?

Why IUL Is A Bad Investment: The Financial Risks Of IUL

People often advertise Indexed universal life (IUL) insurance as a good investment, with its promised high returns.

However, it is seldom the case. The agents earn really high commissions from selling these plans. However, the truth is that very often, high fees, combined with hidden costs, actually drain your savings.

You may not be aware that you are losing money until the policy either performs very poorly or you try to cancel it.

If you think they are misleading you, you should not bear the financial loss alone. Many people are victims of misleading advertising and wrong projections.

Now, let’s say you have lost money because an agent or company has not disclosed the risks of an IUL.

The unsuitable IUL fraud attorneys at RP Legal LLC are there to assist you in taking legal action.

You have the right to make them answerable. You can also claim the amount you deserve as a result of their deceptive practices.

Thus, today, get professional legal guidance and save your future. Consequently, in this article, we will cover everything related to IUL to conclude why IUL is a bad investment!

IUL Cash Value Is A Supercharged Savings Account

Critics frequently state that IUL is a wrongturn, but why IUL is a bad investment?

They compare IUL with other investments and argue that IUL is more volatile!

However, critics of Indexed Universal life insurance who are now supporting the product will still agree that cash value is essentially a better way wrapped in insurance.

And indeed, we do agree!

In the following paragraphs, I will demonstrate the various ways through which the IUL cash value can aid in the growth of your regular savings account.

The returns from IUL are more affluent

The policy’s growth is basically tax-free.

You could claim the tax-free status any time

Above all, you could always take a loan against your IUL policies in case of an emergency or when you would like to invest in an outside opportunity.

At the same time, your full balance would continue to compound inside the policy for your benefit.

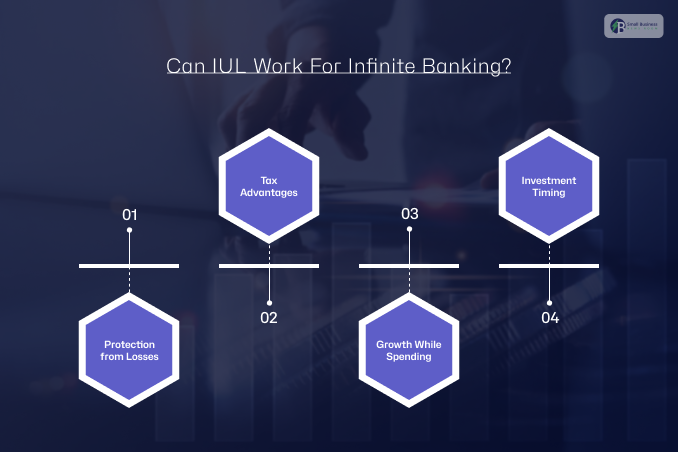

Can IUL Work For Infinite Banking?

The term “Infinite Banking” refers to a method of using the cash value of your life insurance policy as if it were a personal bank account.

You may take out a loan against your own property for major purchases, and at the same time, the policy’s money will continue to grow.

The majority still prefer Whole Life insurance for its reliable and ever-growing income. Still, people often claim that a max-funded Indexed Universal Life (IUL) policy offers superior potential.

An IUL can provide greater long-term profitability and the assurance of not losing value during market downturns, since the S&P 500 index has increased in value over the years, up to a certain point. Using an IUL as your personal bank gives you:

Protection from Losses: The “floor” (which is usually 0%) that keeps your principal intact during a market downturn protects you from losses.

Tax Advantages: You become free of taxes on the amount your money has grown while you have not taken it out through a loan (tax-free).

Growth While Spending: Your cash value could still be increasing even when you have borrowed money for investments in real estate, renovation, or business equipment.

Investment Timing: You will be able to snatch up bargains when the market is down without having to sell your other stocks at a loss. But still, the plans are complicated.

If the agents misinterpret the insurance policies or if they fail to yield the same result. The IUL fraud attorneys at RP Legal LLC would be happy to assist you in making the company accountable.

Why IUL Is A Bad Investment? The Reasons

Purchasing an Indexed Universal Life (IUL) policy is marketed as a “magic” financial tool that provides both insurance and wealth.

Marketers may even guarantee that the policy will generate wealth for future generations, resulting in you paying much more in premiums than necessary for just basic coverage.

In truth, these plans are structured so that the benefit goes more to the insurance company and the agent than to the client.

While you battle with high costs, the person who has brought you the policy earns a hefty commission.

Misleading Marketing: Companies rely on colorful brochures and optimistic financial projections that often fail to align with actual market results.

High Costs: Most of the money you pay for premiums does not go into your savings but is absorbed by hidden fees.

Better Options: In almost all instances, it is more advisable to buy a simpler policy and invest the difference in more conventional investments elsewhere.

If you feel that you have been misled into buying an IUL, then the fraud attorneys at RP Legal LLC will assist you in making the company answerable for the wrongful sale of their deceptive sales tactics.

IUL Issue 1: Your Premiums Are Subject To Significant Added Fees By The IUL Company

It is quite difficult to know where your money goes. Reason? Well, IUL companies often prefer to hide the true cost of their premiums.

While they show you all those glossy, colourful brochures with impressive charts to catch your attention, they smoothly avoid mentioning the hidden fees or the opportunity costs of missing out on better returns elsewhere!

The main truth is that your bill often increases every year due to hidden additions. These hidden additions include:

Premium Loads: The high sales charges that have been taken off the top of your payments.

Expense Charges: The ongoing administrative fees that can drain your account.

Surrender Charges: There can be significant penalties if you try to cancel or access your money.

IUL Issue 2: High Payment Amount For IUL Premium

Indexed Universal Life (IUL) insurance premiums are usually very expensive and can sometimes become a significant financial burden. The following are the main reasons:

High Management Costs: Insurance companies, despite their rhetoric about IULs being great investments, are charging substantial management fees to administer these intricate policies.

Hidden Fees: IULs tend to be very complicated, and that is on purpose. Consequently, companies can, and do, impose all sorts of secret costs and administrative fees that the average person finds very hard to comprehend.

Age-Based Increases: The insurance part of the policy becomes considerably more expensive as you become older.

Therefore, the premiums of the policy rise gradually, forcing you to pay more for the policy in the future when you might no longer be able to.

Financial Risk: Agents may tell you that the policy is always within the reach of your budget, but they are surely considering the scenario where your income does not change.

In case you are unemployed or have a serious health problem, the premiums may rise when you need the coverage the most, and it might become impossible for you to pay them.

The use of the FINRA Insurance Tool or the research of Life Insurance Basics may help you better understand your options.

It’s common for people to find that these rising costs result in their policy being cancelled, leaving them unable to access the benefits.

IUL Issue 3: It Is Hard To Get Out Of An IUL

It is really tough and also costly to get out of an Indexed Universal Life (IUL) policy. This explains why IUL is a bad investment!

If you try to cancel your policy, it is more than likely that you will lose a significant part of the money you had put in. Here are the reasons it is hard to leave:

First comes the Steep Surrender Charges. Insurers impose substantial fees if the policy is terminated before maturity.

Then come the Such charges, which typically exceed the actual cost of the account’s closure by a wide margin.

During the policy’s initial period, a large portion of your money is spent on high setup charges rather than on growing the future value. Hence, you have very little “cash value” to recover.

Last come the expensive riders. There are a few companies that propose to reduce their exit fees only if you pay more for an “enhanced cash value” rider, which means you have to spend more money upfront.

The “Financial Bath”: When the policy grows, the exit fees are so high that you still end up losing money.

The insurer is not obligated to put your interests first. If you were misrepresented when buying a poor policy, your best recourse is to sue the company.

To find out about your rights, visit the National Association of Insurance Commissioners or consult FINRA’s insurance products guide.

Is IUL A Good Or A Bad Investment For Retirement?

There is an old saying that says:

“Stocks tend to take the stairs on the way up, but they use the window on their way down.”

IUL Acting As A Retirement Risk Buffer

An Indexed Universal Life (IUL) insurance policy can serve as a buffer against the stock market crash for your savings.

The reason behind this is the IUL having a “0% floor” feature, thus you won’t incur any losses even if the market is hit hard.

This security can be viewed as a fundamental part of your entire retirement plan:

Prevent the “Death Spiral”: If the market is down and you withdraw some money from a traditional 401(k), you will have to sell more shares to get the same amount of cash. These shares are then gone and cannot grow back when the market recovers.

A Financial Cushion: During a market crash, you can take income from your IUL rather than your stocks. This allows your stock portfolio time to “heal” and regain its value.

Easier Recovery: A 50% market drop means a 100% gain is needed just to get back to zero.

With an IUL, you limit your losses to 0%. The IUL keeps your balance stable, so you do not have to go through the stress of catching up.

The IUL may not offer the same rapid growth as the stock market during the best of times, but it still serves as a refuge during the worst of times.

You can check the various kinds of retirement saving tools through the FINRA Retirement Calculator or visit the SEC Investor Education page for more about market risks.

IUL Acting As A Better Proxy For Bonds

Historically, when stocks fell, investors made their portfolios safer by investing in bonds.

In contrast, today’s bonds can also lose significant value. For instance, during the 2022 stock market crash, some bonds fell by more than 25%.

The IUL policy, unlike bonds, has a “0% floor,” which makes it safer. This way, you will be able to secure your money even when the market declines.

This safety is crucial for retirement savings. The IUL offers a superior option with tax-free growth potential, enabling you to avoid massive losses during times when you need your cash most.

IUL Acting As A Tax Shelter

An Indexed Universal Life (IUL) policy is an excellent means of tax savings. To be precise, you pass through a 401(k) plan.

On the other hand, an IUL gives you the chance to enjoy tax-free growth and tax-free income. Visualize your 401(k) as a “tax mortgage.”

You are not saving; you are merely postponing a payment that gets bigger each year. Not only that, the government can always change the tax rates to its advantage.

An IUL is a smart choice to go hand in hand with your 401(k) because of the following:

Tax Control: You can withdraw money from your IUL to remain in a lower tax bracket.

Market Protection: What to do when the market is down? Well, you can support yourself with your IUL instead of selling your stocks at a loss.

Tax-Free Access: You can access your funds at any time without the penalties often applied to other accounts.

Also Check: What Are Two Questions That Smart Spenders Ask Before Making A Purchase?

Why You Must Sue A Company That Sells IULs?

What happens when you suffer from significant losses from an Indexed Universal Life (IUL) insurance policy? The insurance company might be liable for a lawsuit on your part.

Misconceptions about how the policy works lead many people to drop out due to increased premiums. Consequently, to lose everything. You might have the case based on the following:

Hidden Risks: The insurance company gave you no clue about the risks or other important facts before you took out the policy.

High Fees: The amount you were charged included unreasonable or unclear expenses.

Bad Advice: The policy was not a good match for your financial goals or needs.

Dishonesty: The salesperson lied or made false promises just to get you to sign up.

Thus, there is a high possibility that the customers will end up with nothing when they try to cash out their policies.

Now, if you believe you are a victim of wrongdoing, it is better to act quickly.

The National Association of Insurance Commissioners (NAIC) can guide you on how to file a complaint. Or you may contact your State Department of Insurance to report unfair practices.

You may also consider seeking legal counsel from a lawyer who specializes in insurance fraud cases. This could help recover your lost funds.