Table Of Contents

- How Many Jobs Are Available in Finance?

- The Highest Payment Carrier In Finance

- 1. Chief Financial Officer (CFO)

- 2. Investment Banker

- 3. Hedge Fund Manager

- 4. Financial Controller

- 5. Financial Analyst

- How To Start A Career In Finance Without Experience

- 1. Buy related conclusions or related certifications

- 2. Gather your entry experiences

- 3. Building financial skills

- 4. Networks within the industry

- 5. Stay up to date with industry trends

- Finance Roles and Responsibilities

- 1. Chief Financial Officer (CFO)

- 2. Financial Manager

- 3. Financial Analyst

- 4. Financial Advisor

- 5. Treasury Manager

- 6. Budget Analyst

- 7. Investment Banker

- 8. Credit Analyst

- 9. Actuary

- 10. Risk Analyst

How Many Jobs Are Available in Finance? A Comprehensive Guide to Careers in Finance

When someone asks me, ‘What is the dynamic sector in the global economy?’ I always say it is the financial industry.

Need financial planning, investment management, or financial technical services? Finance has always played a major role in managing businesses and individuals. You need the correct guide!

This is enough to understand how to succeed at your own pace.

So, if you’ve ever wondered how many jobs are available in finance, the answer is very simple! There is a lot to be done in the industry through some experience and specialization. In this blog, I will look into the following:

- How many jobs do you need in finance?

- Most paid careers in finance

- How do I launch a financial career with no prior experience?

- Key occupations and responsibilities for financial-related jobs

So, while learning everything about this exciting area, read what it offers and why it is one of the most demanding career paths these days.

How Many Jobs Are Available in Finance?

The financial industry currently offers millions of job opportunities worldwide.

According to the Bureau of Labor Statistics, the finance and insurance sector employed more than 7.6 million people in the United States as of 2023.

How many jobs do you need in finance? The answer depends heavily on how much you want to define the entire field.

Whether it’s large or small, every company needs professional guidance.

- Manage your budget

- Analyse all risks

- Prepare the report

- Provides professional guidance

Additionally, financial roles continue to switch to new roles and areas such as:

- Fintech (financial technology)

- Environmental, Social, and Governance Investment (ESG)

- Cryptocurrency and blockchain finance

- Data analysis and financial automation

If you are currently considering a great career in finance, you must say, “How many jobs are available in finance?” It’s not a limiting factor.

The Highest Payment Carrier In Finance

The financial sector offers a wide range of roles. However, some positions can easily stand out because of their excellent revenue potential.

In this section, we will look at some of the best-paid financial careers and related careers.

1. Chief Financial Officer (CFO)

Average Salary: $187,000 per year

Important Responsibilities:

- Monitor the entire company’s financial strategy and operations.

- Manage your budget,

- Ensure compliance with official compliance

- Related investor relations.

2. Investment Banker

Average Salary: USD 150,000-250,000 per year

Important Responsibilities:

- Support clients with mergers,

- Acquisitions and capital raising activities.

- Working with government agencies and large companies.

3. Hedge Fund Manager

Average Salary: $158,000

Important responsibilities:

- Manage your investment portfolio,

- Analyze market trends, and

- Maximize investor returns.

4. Financial Controller

Average Salary: 110,000-160,000 US$ per year

Important Responsibilities:

- Management of internal financial processes;

- Prepare the report

- Guaranteed for details.

5. Financial Analyst

Average salary: $99,890 per year

Important Responsibilities:

- Analyze financial data and

- Predict future performance,

- Providing implementable knowledge for business decision-making.

These positions not only offer high pay but also offer significant career growth and leadership options.

How To Start A Career In Finance Without Experience

If you are interested in finance but have no formal experience, don’t start your financial career from scratch. Here, you can put your feet up.

1. Buy related conclusions or related certifications

Final options: Financing, Accounting, Economics, Management

Certified: Don’t forget your login information for chartered financial analysts (CFAs), certified public accountants (CPAs), and financial risk managers (FRMs).

2. Gather your entry experiences

Apply for volunteer functions that provide basic knowledge of internships, part-time jobs, or financial tasks.

Entry-level positions, such as junior analysts, accounting assistants, and banking clerks, are great starting points.

3. Building financial skills

Develop expertise in Excel, Financial Modeling, Budgeting, and Data Analysis. Online platforms such as Coursera, Udemy, and LinkedIn Learning offer excellent financial courses for beginners.

4. Networks within the industry

You can always look for financial conferences, workshops, and webinars to stay informed to stay informed. Join professional financial associations and connect with financial professionals on LinkedIn.

5. Stay up to date with industry trends

Build an understanding of real financial events according to financial news, stock market, trends, and economic reports.

Remember how many jobs are available to new employees, especially those who are motivated to learn.

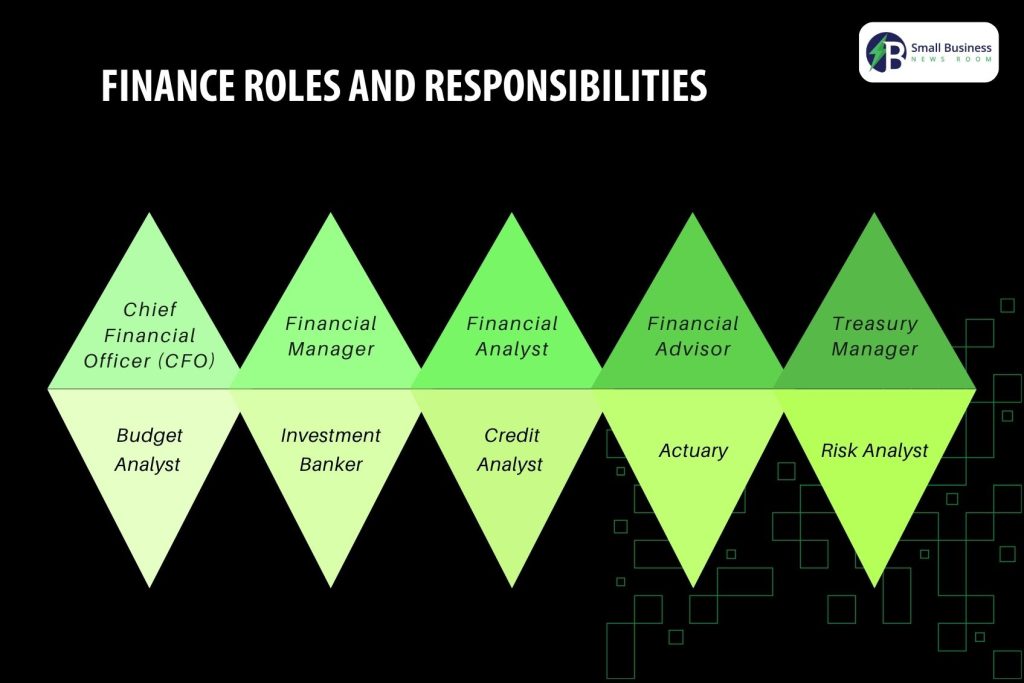

Finance Roles and Responsibilities

The financial industry is filled with a variety of roles that require a variety of interests and skills. Each position is equipped with a unique responsibility to contribute to the general financial health and organizational growth.

Whether you’re dealing with analytics, strategy, or customer-oriented work, there’s probably a fundraising role that fits your ambitions.

This gives a detailed look at some of the most common and popular financial tasks.

1. Chief Financial Officer (CFO)

A Chief Financial Officer (CFO) is crucial in determining a company’s financial well-being and long-term prosperity.

As the head financial officer, the CFO is responsible for formulating monetary policy and spearheading efforts that lead to fiscal prosperity.

They concentrate on creating long-term financial strategies, budgeting, investing, and capital structuring.

CFOs also oversee risk, finance compliance, and open investor communication. Much of their work is coming up with proper projections and matching financial strategies with the company’s objectives.

Average salary range: $150,000 – $400,000+ per year, including bonuses and equity in bigger companies.

2. Financial Manager

A Financial Manager makes sure the company’s daily financial tasks go well and are correct. They watch over all accounting activities and ensure that rules for handling money are followed and are working properly.

They manage payroll, accounts, and payments, and also prepare clear financial reports, so their jobs cover a lot of areas.

Financial managers help with planning budgets and make sure the business follows money rules at the local, state, and even international levels.

Average salary range: The average salary is between $90,000 and $150,000 each year.

3. Financial Analyst

A financial Analyst assists agencies in making the right financial choices with the use of trends and information.

He or she develops complete financial models that help businesses in making funding and budgetary choices.

From studying past data, they have a look at overall performance and forecast revenue, prices, and profit.

They present those findings to stakeholders to demonstrate funding possibilities and become aware of marketplace competition.

Their position is of paramount importance in preserving businesses financially up to date and making plans for the future.

Average salary range: The average income is $65,000 – $110,000 per year.

4. Financial Advisor

A financial guide advises people and agencies on achieving their financial targets. They advise on investments, retirement planning, tax saving, and asset planning.

Monetary advisors are updated on trends in the marketplace, new products, and regulatory adjustments, so they can offer informed pointers.

They do not work with figures; they work with building top consumer relationships and with coaching clients on a way to avoid threats and hold their coins safe.

Average salary range: The average income is $60,000 to $130,000 or more annually, perhaps with commissions and bonuses.

5. Treasury Manager

A Treasury Manager has responsibility for the firm’s cash position and overall financial well-being.

Their responsibility is to make certain that there is adequate liquidity to finance daily operations and upcoming investments.

They establish short-term financing requirements, project future cash positions, and foster good banking and other financial institution relationships.

They watch for currency risks and assist in protecting the company from exchange rate movements. Treasury managers shape corporate financing policy and administer short-term investment activities.

Average salary range: The average income is $95,000 – $160,000 annually.

6. Budget Analyst

A Budget Analyst is crucial to keeping a company in good financial condition through cost containment and budget planning.

They review department budgets to ensure they align with company objectives. By monitoring expenditures and identifying areas of fiscal distress, they make operations run more efficiently.

Moreover, budget analysts routinely recommend adjustments to make operations less expensive.

They prepare financial projections and collaborate with management to formulate realistic and effective budgetary strategies.

Average salary range: The average income is $65,000 – $100,000 annually.

7. Investment Banker

An investment Banker is typically at the center of large finance transactions, especially on Wall Street.

They assist clients, regularly large groups or government agencies, in raising cash and making complicated financial transactions together, including mergers and acquisitions.

Their work involves conducting full-size market studies, studying investment hazards, and developing unique financial plans for such things as IPOs or promoting debt.

Furthermore, Investment bankers also provide strategic counsel, supporting their clients in making knowledgeable financial decisions with confidence.

Average salary range: The average annual salary is between $120,000 and more than $250,000, plus enormous performance bonuses.

8. Credit Analyst

A Credit Analyst determines whether a government, business, or individual will repay money borrowed.

They analyze financial reports and other reports to determine the likelihood of lending. Depending on what they discover, they advise credit ratings, interest rates, and terms of the loan.

Moreover, they track existing credit accounts for issues as well and create detailed reports to utilize for lending. Their results allow banks and lenders to make more informed loan decisions.

Average salary range: The average annual salary is $60,000 – $95,000 per year.

9. Actuary

An actuary is an expert who measures financial risk through the use of math and statistics. Actuaries typically work in the field of insurance and pension planning.

Actuaries examine how much of a risk investments or insurance policies are by applying models that predict future occurrences.

Moreover, actuaries’ efforts minimize financial loss and enable companies or individuals to make informed financial decisions.

From writing reports for insurance firms to assisting companies with risk planning, actuaries play a large role in financial planning and protection.

Average salary range: The pay scale ranges from $100,000 to $180,000 annually, depending on experience and qualifications.

10. Risk Analyst

A Risk Analyst assists businesses in comprehending and managing the financial risks they are exposed to.

They consider potential risks from market volatility, business fluctuations, or investment selection and suggest what the business might do to prevent the risks, such as diversifying investments or applying hedging.

Risk analysts also prepare reports that summarize emerging risks and how they might influence the business.

They collaborate with compliance groups to make sure the firm complies with all the regulations and monitor international economic indicators that may impact business outcomes.

Average salary range: The pay scale ranges from $70,000 – $120,000 annually.

Read More: