Table Of Contents

- What Is Quick Commerce?

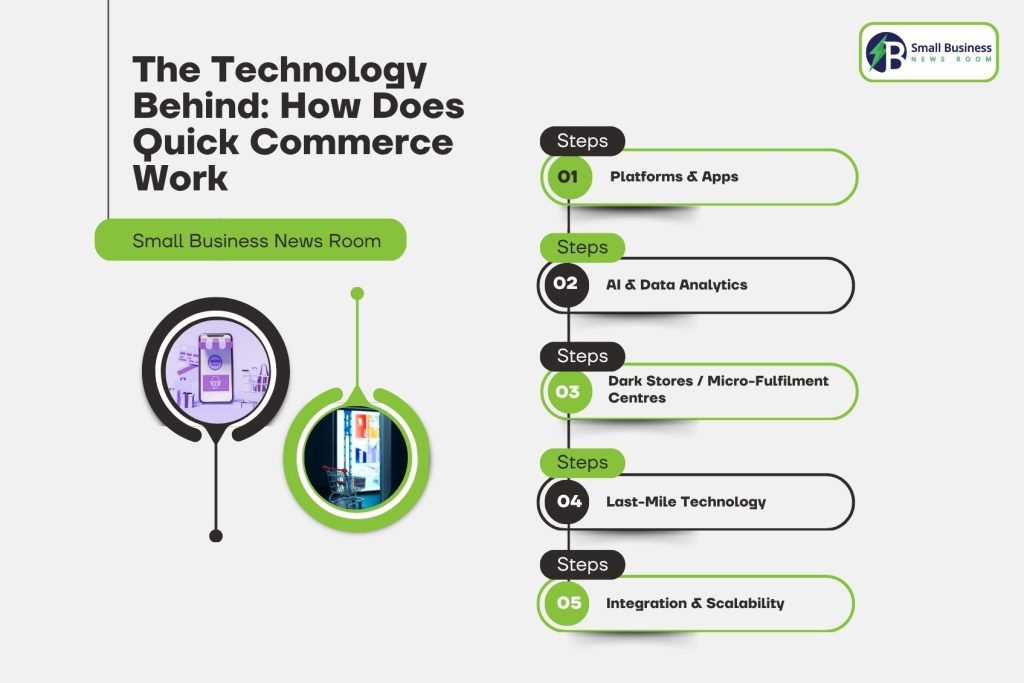

- The Technology Behind: How Does Quick Commerce Work?

- 1. Platforms & Apps:

- 2. AI & Data Analytics:

- 3. Dark Stores / Micro-Fulfilment Centres:

- 4. Last-Mile Technology:

- 5. Integration & Scalability:

- Who Are The Key Players In Quick Commerce?

- Overview Of Consumer Trends Driving Quick Commerce Growth

- What Are The Challenges In Quick Commerce?

- 1. Logistics & Supply Chain Complexity:

- 2. Sustainability & Environmental Impact:

- 3. Market Saturation & Competition:

- 4. Profitability & Unit Economics:

- 5. Regulatory & Urban Logistics Constraints:

- 6. Inventory & Stock-out Risk:

- What Is The Future Of Quick Commerce?

- 1. Autonomous Delivery & Drones:

- 2. Expanded Product Categories:

- 3. Hyper-Local & Subscription Models:

- 4. Integration Into Omni-Channel Retail:

- 5. Tier 2/3 City Expansion & Tailored Models:

- 6. Sustainability & Smarter Routing:

- 7. Data-Driven Personalisation & Consumer Behaviour Change:

How Quick Commerce Is Revolutionizing The Retail Market!

In today’s world of instant gratification, quick commerce is taking off as consumers increasingly expect near-instant access to goods.

The shift from “order now, wait days” to “order now, arrive minutes later” is more than just a convenience—it’s reshaping the retail market in real time.

As urban lifestyles accelerate and shopping becomes more of a mobile, on-demand experience, quick commerce stands out as the frontier of speed.

In this article, I will focus on the following things:

- What is quick commerce?

- How does q-commerce work?

- The key players in quick commerce.

- Consumer trends in quick commerce.

- Challenges in q-commerce.

- The future of quick commerce.

Therefore, if these are some of the things that you want to know, keep on reading this blog till the end…

What Is Quick Commerce?

At its core, quick commerce (sometimes written “q-commerce”) refers to a style of shopping where orders are placed online and delivered to the customer in a very short timeframe often within an hour or even 10–30 minutes.

Unlike traditional e-commerce, which might promise delivery within days or up to a week, quick commerce flips the script by emphasising “instant delivery” of everyday essentials, groceries, snacks, personal care items, and sometimes even electronics or gifts according to Channel Sight.

As per Locus, what gives it scope is the combination of ultra-tight logistics, micro-fulfilment setups (such as local “dark stores” or fulfilment hubs near dense urban zones), and mobile apps that make ordering seamless.

Basically, quick commerce is the next generation of e-commerce, defined by ultra-fast delivery and hyper-local fulfilment, purpose-built for urban consumers who value speed, convenience, and minimal wait time.

The Technology Behind: How Does Quick Commerce Work?

Driving quick commerce today is a potent mix of mobile delivery apps, advanced analytics/AI, real-time inventory monitoring, and a fleet of last-mile infrastructure deployed very close to the customer base.

1. Platforms & Apps:

The consumer-facing layer is typically a mobile app (or web interface) where you place an order for immediate delivery—whether groceries, essentials or convenience items. This “on-demand delivery” model is what differentiates quick commerce from conventional shopping.

2. AI & Data Analytics:

Behind the scenes, AI-powered logistics decide which fulfilment location (dark store) will service the order, which delivery partner (rider) is optimal, which route minimises time, and how inventory should be managed to anticipate fast orders. According to Netguru, analytics also help forecast demand, optimise stock levels in each micro-hub, and reduce wasted time.

3. Dark Stores / Micro-Fulfilment Centres:

Instead of traditional big warehouses far from the customer, many quick commerce players deploy small fulfilment centres or “dark stores” located inside city zones or highly populated neighbourhoods. Because they hold a limited SKU set (typically high-turn items) and are close by, fulfilment time (picking, packing, dispatch) is dramatically reduced.

4. Last-Mile Technology:

Delivery apps + routing + real-time tracking + often electric bikes or scooters for rapid movement—this is the last-mile layer that actually physically gets the product to the doorstep. In many cases, the promise is sub-30-minute or even 10-minute delivery windows.

5. Integration & Scalability:

The system is integrated end-to-end—from the consumer order, inventory check, fulfilment assignment, delivery dispatch, to status tracking. Scalability becomes a technology and logistics challenge: how many dark stores, how many delivery riders, how many orders per hour can be processed and delivered in minutes.

Note: Because of these layers working in unison, quick commerce is not just a marketing slogan—it’s a genuine operational model that requires real infrastructure and tech. This is why it’s increasingly being called “instant delivery” or “on-demand delivery,” rather than simply “e-commerce”.

Who Are The Key Players In Quick Commerce?

The quick commerce space has already attracted major players and startups alike. Here are some noteworthy names and how they differentiate themselves:

In the U.S., platforms such as GoPuff, DoorDash, and Instacart are cited as leading the quick-commerce wave, delivering convenience-store-style goods, groceries, and household essentials via rapid fulfilment networks.

Cornell SC Johnson states that in India and parts of Asia, firms like Blinkit (formerly Grofers) and Zepto are aggressively expanding, with dark-store networks and hyper-local delivery within 10-minute windows.

Business models typically involve: stocking a curated subset of high-turn SKUs, placing micro-fulfilment centres in dense urban zones, charging a delivery fee (or absorbing it via subscription/membership models), and sometimes offering ultra-fast delivery slots (15-30 minutes) as a differentiator.

These companies are reshaping the retail ecosystem: what was once the domain of brick-and-mortar stores + standard e-commerce is now speeding into a model where “order now, delivered within minutes” is viable.

While some players are have the funding that they need and are scaling fast, the competition is fierce. Additionally, the profitability remains a challenge in many markets.

Overview Of Consumer Trends Driving Quick Commerce Growth

Several consumer behaviour factors are fueling the growth of quick commerce—speed, convenience, urban density, mobile penetration and changing shopping habits play major roles.

Urban consumers increasingly expect faster service for everyday essentials. The longer “2-3 day shipping” of standard e-commerce is no longer enough for many. Platforms offering “under an hour” or “within 30 minutes” are winning attention.

According to research, in Europe, many quick-commerce users order 2-4 times per month, and about 8 % of users order five or more times per month via fast-delivery services. For many, this is replacing weekly grocery shopping trips.

On a global scale, experts and data trends project that the quick commerce market will grow rapidly. For instance, one estimate suggests a market size of USD 75.9 billion in 2023, growing to USD 626.5 billion by 2033 at a CAGR of ~23.5 %, according to Market.us.

In the Asia-Pacific region, especially in India, growth is particularly steep due to high urbanisation, mobile smartphone adoption, and changing lifestyles.

The behaviour shift is not just about groceries. As consumers grow comfortable with instant delivery of groceries and essentials, their willingness to order more frequently and impulsively (thanks to convenience) increases. This creates new opportunities for upselling, bundling, and “impulse delivery” of items.

Also, convenience has become a value category: consumers are more willing to pay a premium (or accept a subscription fee) for speed and reliability. That means quick commerce isn’t just about “cheap” but about “fast + convenient”.

In sum, changing consumer expectations are rewriting the rules of retail: speed matters, location matters, mobile matters—and quick commerce is at the heart of this shift.

What Are The Challenges In Quick Commerce?

While quick commerce is promising, it is not without its challenges. The operational intensity and cost structure raise several hurdles:

1. Logistics & Supply Chain Complexity:

Operating many dark stores across urban zones means high fixed costs (rent, staffing, inventory). The last-mile delivery itself is cost-intensive. Achieving profitability while delivering in 10–30 minutes is a major challenge.

2. Sustainability & Environmental Impact:

The model often requires many small deliveries over short distances; unless planned efficiently (bike couriers, EVs, consolidated trips), the carbon footprint per item can be higher than conventional delivery. According to Fortune Business Insights, some regions are already emphasizing eco-friendly delivery modes.

3. Market Saturation & Competition:

Because speed and coverage are becoming standard expectations, differentiation becomes harder. Many players are offering similar delivery promises, which drives margin compression. In some markets, firms are cutting back hours, increasing minimum order sizes or reducing delivery speed to preserve margins.

4. Profitability & Unit Economics:

The basket sizes tend to be smaller (everyday essentials). However, the delivery speed expectations are high which places pressure on margins. Reuters stated that unless economies of scale or premium pricing/subscriptions are used, the unit economics can be thin.

5. Regulatory & Urban Logistics Constraints:

Urban zones are congested; zoning, traffic, labor regulation (for gig couriers) and local restrictions can make timely delivery challenging. Also, scaling to Tier 2/3 cities is more difficult logistically and might kill margin.

6. Inventory & Stock-out Risk:

Finally, because dark stores hold a limited SKU set near the customer, demand forecasting must be precise. Otherwise, stock‐outs or overstock (waste) can occur very easily. The window for error is small because the promise is speedy.

What Is The Future Of Quick Commerce?

Looking ahead, quick commerce is all set for further innovation and evolution. Here are several future directions and opportunities:

1. Autonomous Delivery & Drones:

As urban logistics evolve, many firms are exploring drone delivery, robotics or autonomous vehicles for last-mile fulfilment, which could reduce delivery times and cost. This is especially plausible in dense urban zones or campus‐style settings.

2. Expanded Product Categories:

While early quick commerce focused on groceries and ‘convenience’ items, future models will extend to higher value goods (electronics, apparel) or services (e.g., pharmacy, food + grocery combined). Some markets already show this trend.

3. Hyper-Local & Subscription Models:

Firms might pivot to subscription-based “micro-fulfilment memberships” where frequent users subscribe for ultra-fast delivery and other perks—thus improving loyalty and average order value.

4. Integration Into Omni-Channel Retail:

Brick-and-mortar retailers may convert parts of their store real estate into mini-fulfilment hubs, blending stores and micro-fulfilment. Supermarkets, pharmacies and convenience chains will likely adopt quick-commerce infrastructure natively.

5. Tier 2/3 City Expansion & Tailored Models:

Once urban core models are mature, expansion into smaller cities will depend on modified models (longer delivery windows, fewer dark stores). But, the underlying promise of faster delivery will still apply.

6. Sustainability & Smarter Routing:

To scale profitably and responsibly, firms will adopt more eco-friendly delivery fleets, better routing algorithms, and consolidation of deliveries to reduce per-order cost and environmental impact.

7. Data-Driven Personalisation & Consumer Behaviour Change:

With real-time data, firms can anticipate consumer needs (“you’ve run out of milk, order now”) and potentially convert quick commerce into a cadence of shopping rather than panic orders, thereby increasing loyalty and revenue per user.