Table Of Contents

- Understanding Traceloans.com Auto Loans

- Types of Auto Loans Available

- How to Apply for an Auto Loan: Traceloans.com Auto Loans

- Benefits of Choosing Traceloans.com Auto Loans

- Convenient Web Process

- Several Loan Offers

- Swift Approvals

- Inclusive Service

- Transparency of Terms

- Educational Aids

- Responsive Service

- Tips for Securing the Best Auto Loan Rates

- Review and Improve Your Credit Score

- Determine Your Budget

- Compare Annual Percentage Rates (APR)

- Consider a Larger Down Payment

- Prequalify with Multiple Lenders

- What Makes Traceloans.com Auto Loans Stand Out?

- Transparency

- Tailored Loan Options

- Fast and Easy Approval Process

- Competitive Interest Rates

- Expert Guidance and Support

- Wrapping It Up!

Traceloans.com Auto Loans: Your Guide to Hassle-Free Car Financing

Car ownership brings excitement, but the funding process can be mentally stressful. That’s where Traceloans.com auto loans come in!

The website provides users with a straightforward method. This way, you can secure their auto loans without any difficulties.

Traceloans.com auto loans serve all buyers of new or used vehicles. Moreover, it caters to those who need to refinance existing loans by finding you the best rates and term flexibility.

You can go through their fast and digital application to browse competing loan offers from different lenders without stress.

Moreover, their acceptance policy covers all credit ratings. Thus, automobile ownership is available to everyone.

Your financial needs come first to Traceloans.com auto loans. The site eliminates confusing terms and makes all fees visible during the process. Its resources and excellent support services ensure that customers obtain optimal financial deals.

Online users seeking a simple way to finance their next vehicle should consider Traceloans.com auto loans.

Understanding Traceloans.com Auto Loans

Do you want to purchase a car but are nervous about financing? Traceloans.com auto loans make it easy and hassle-free!

So, whether you want a new vehicle, a used vehicle, or a refinance, they match you with lenders who offer excellent rates and flexible terms.

The best part? The entire process is online—no time-consuming paperwork or confusing jargon. Just apply, shop the offers, and select the one that’s best for you.

Moreover, they work with people of all credit scores, so you still have options even if yours isn’t perfect.

Traceloans.com auto loans make it easy and transparent—no hidden fees, no surprises. And their customer service and loan services help you make smart money decisions.

Do you need a hassle-free and easy way to finance your next car? Traceloans.com auto loans are well worth a look!

| Overview of the Key Features of Tranceloans.com • Diverse Loan Options: Access to new and used car loans, refinancing opportunities, and lease buyout loans. • Competitive Interest Rates: Partnerships with multiple lenders to offer favorable rates. • Simplified Online Application: A straightforward process that reduces paperwork and saves time. • Support for All Credit Scores: Assistance for borrowers across the credit spectrum, including those with less-than-perfect credit. |

Types of Auto Loans Available

Knowing the various kinds of auto loans will enable you to pick the most appropriate one for you:

- New Car Loans: Auto financing for new vehicles, typically with lower interest.

- Used Car Loans: Used car financing, typically with slightly higher interest owing to depreciation.

- Refinance Loans: Options to modify your existing auto loans, perhaps for better terms or lower payments.

- Lease Buyout Loans: Auto financing to purchase a car at the end of the lease period.

- Bad Credit Loans: Special financing is available for bad credit holders, but they may have higher interest.

- Private Party Loans: Auto financing to purchase cars directly from an individual, not a dealer.

- Cash-out refinance Loans allow you to refinance your vehicle for more than the amount owed, providing you with cash for other purposes.

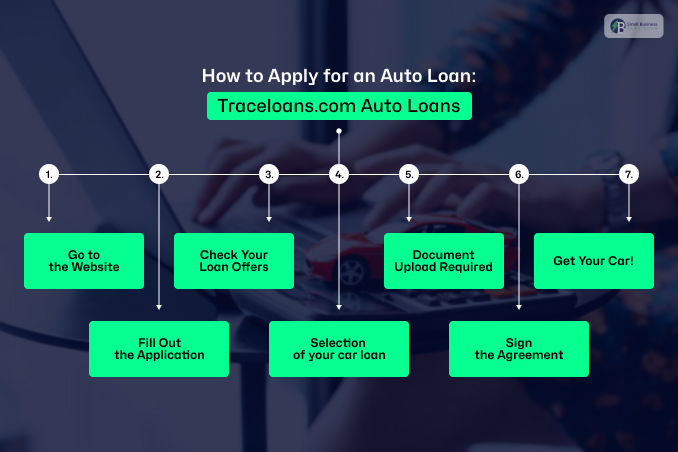

How to Apply for an Auto Loan: Traceloans.com Auto Loans

Traceloans.com auto loans exist for simple acquisition. Here’s how it works:

First step: Go to the Website

Users must navigate to lender’s site and select the “Auto Loans” section from the homepage.

Second step: Fill Out the Application

Users can complete their applications by providing simple income details and more information about their work. It only takes a few minutes!

Third step: Check Your Loan Offers

Submitting your loan application brings about personalized loan offers from various banking institutions.

Fourth step: Selection of your car loan

Select the most suitable loan by finding a solution that fits your financial circumstances.

Fifth step: Document Upload Required

The process may ask for information such as identification documents, proof of income, and credit details.

Sixth step: Sign the Agreement

Sign the Agreement after lenders approve your application by e-signing the loan contract.

Seventh step: Get Your Car!

You can purchase your ideal car after securing the financing.

Easy, right? 🚗💨💨

| Eligibility Criteria That You Need for Tranceloans.com 1. The age should be at least 18 years old. 2. Proof of stable income through pay stubs, tax returns, or bank statements. 3. Your credit score has a minimum requirement that differs for each loan approval rate and will improve based on score quality. 4. The required down payment is 10% to 20% of the vehicle’s cost, but individual circumstances may dictate a different amount. 5. Legal residency status in the country where the loan application is made is a requirement. |

Benefits of Choosing Traceloans.com Auto Loans

No more hassle. No more time-wasting visits to multiple dealerships and banks. Traceloans.com simplifies it for you:

- Quick,

- Hassle-free, and

- From the convenience of your own home.

Here’s why to use it:

Convenient Web Process

First, Get your car loan from home—no visits to several banks and dealerships. All online and save your time!

Several Loan Offers

Secondly, you can receive several loans offers and compare them to pick the most suitable one within your budget and needs.

Swift Approvals

Thirdly, your loan application will be swiftly approved, allowing you to buy your new vehicle and take it home sooner.

Inclusive Service

Next is inclusive services. No good or bad credit score is an issue! Traceloans.com ensures you get the right loan that is suitable for you.

Transparency of Terms

Fifth, we have transparency in terms and conditions. No obscure charges and incomprehensible terms—clear to understand and straightforward, so you know you’re getting a clear deal!

Educational Aids

Next, they also provide educational resources and resources for a great car loan experience. So, plan your finances with loan calculators and tools before deciding on your auto loan.

Responsive Service

Lastly, do you have some questions? Don’t worry—supportive assistants are always present to help guide you through every step.

Trust me! Borrowing a car has never been easier!

Tips for Securing the Best Auto Loan Rates

To attain the top auto loan deal, do some basic preparation. Basic preparation work creates significant positive results. Several straightforward steps will help you secure an excellent loan opportunity.

Review and Improve Your Credit Score

To get better interest rates, you must check your credit report for errors and pay off your debts to improve your score.

Determine Your Budget

Before you choose a vehicle, check what you can truly afford to spend on payments, insurance, and car maintenance expenses, together with all related costs for owning a car.

Compare Annual Percentage Rates (APR)

APR provides you with a complete financial understanding of your loan because it involves all the fees in addition to standard interest rates.

Consider a Larger Down Payment

Making a larger upfront payment for your home leads to borrowing less money so you can get better interest rates and reduced monthly payments.

Prequalify with Multiple Lenders

Obtain prequalification from various lenders to examine interest rates while securing the top offer without impacting credit score.

Taking these steps today leads to significant financial savings in the future.

What Makes Traceloans.com Auto Loans Stand Out?

Auto loan selection becomes easy at Traceloans.com, which removes the complexity of the process.

Traceloans.com provides transparent services that can help you get quick loan approvals and individualized choices for finding the best car financing option. Here’s what sets them apart:

Transparency

Users see every fee upfront when they start their loan term search at Traceloans.com. Traceloans.com provides a complete understanding of your loan commitment before you borrow, allowing you to make financing decisions with assurance.

Tailored Loan Options

Everyone’s financial situation is different. The Traceloans.com platform matches interested customers with suitable financing solutions for new car loan refinancing or substandard credit financing.

Fast and Easy Approval Process

No long waits or complicated paperwork. The quick application process allows the approval process to occur swiftly so you can obtain financing without enduring delays.

Competitive Interest Rates

Permission to save money lies in decreased interest rates. Traceloans.com pairs you with different lenders across the market to discover loans matching your budgetary needs.

Expert Guidance and Support

Not sure which loan is best? The professional team stands by assisting clients through the loan process by answering inquiries and providing helpful advice about the right financial decision.

With all these benefits, Traceloans.com makes financing a car stress-free and simple!

Wrapping It Up!

In conclusion, Traceloans.com simplifies car financing, making it hassle-free and transparent. Moreover, with customized loans, fast approvals, and professional advice, you receive the best deal without the hassle.

For new, used, or refinancing purchases, they have you covered. Desire a hassle-free car financing experience? Visit Traceloans.com today! 🚗💨

Read Also: